New analysis by Phoenix Insights, Phoenix Group’s longevity think tank, finds the UK is less than two decades from crisis point where nearly three in five defined contribution (DC) pension savers will enter retirement with savings below expectations or below an adequate level.

Tomorrow’s problem?

The UK’s pension system is at a critical juncture, with significant concerns about the adequacy of retirement incomes for future generations. Phoenix Insights has published its latest report ‘Tomorrow’s problem? Analysing the future impact of DC pension undersaving’ mapping out when and how the undersaving crisis will materialise over time.

The analysis, undertaken with Frontier Economics, groups future retirees into five categories* to estimate whether they are saving enough to meet their future retirement needs based on the Pension and Lifetime Saving Association (PLSA) retirement living standards**.

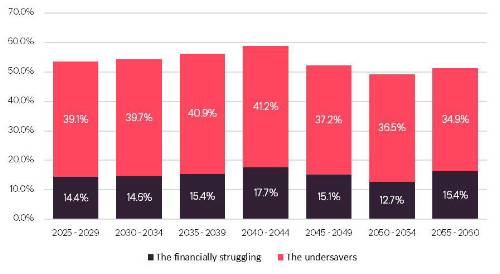

Between 2025 and 2060, over half (54%) of retirees with a DC pension are projected to be either “undersavers” (individuals expecting at least the PLSA’s minimum retirement income standard but not on track to achieve expectations) or “financially struggling” (individuals expecting a retirement income below the PLSA minimum retirement living standard).

Percentage of newly retired DC savers classified as “undersavers” or “financially struggling”

Figure 1: Frontier Economics analysis of Phoenix Longer Lives Index data (October, 2024)

The years 2040 to 2044 represent a critical period, as it will see the highest number of “financially struggling” or “undersavers” reaching retirement (Figure 1). Three in five (59%) of all new DC savers retiring during this period will fall into these two categories of concern, equivalent to 2.67 million people.

The analysis finds this group are predominantly born in the 1970s, female, working full-time, earning below £80k (about half of them earn below £20k) and expecting to retire between the ages of 66 and 70.

Patrick Thomson, head of research analysis and policy at Phoenix Insights “The analysis paints a bleak picture of future retirement incomes. We are already reaching the stage where the majority of people with a defined contribution pension will enter retirement with either less than they expect, or less than they need in terms of a minimum living standard. This situation is set to worsen over time and peak in the next 20 years.

“There is an urgent need to address undersaving to better support people achieve financial security later in life. Immediate policy interventions should include a plan to increase minimum auto-enrolment contribution rates when the economic conditions allow. And this should go hand-in-hand with policies to make work more sustainable and accessible for the over-60s, so people can continue to earn and save later in life.

“The plight of retirement incomes is clear to see, but we have a golden opportunity to take meaningful action to turn the tide in undersaving and improve the retirement prospects of future generations. These really aren’t tomorrow’s problems anymore.”

|