There are 400 Junior ISA (JISA) accounts held in the UK with a value of at least £100,000, according to a Freedom of Information (FOI) request1 submitted by Standard Life, part of Phoenix Group, as part of its analysis into the long-term impact of saving and investing for children.

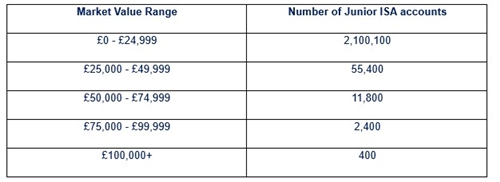

Across the UK, many parents are setting their children up with savings to access when they reach adulthood, with the FOI request revealing there are 2,170,000 JISAs held, which will be passed onto the child recipient once they reach 16 years old. These contain an average value of £4,370, with the majority of accounts having up to £25,000 saved:

Helping a child with a headstart on retirement saving

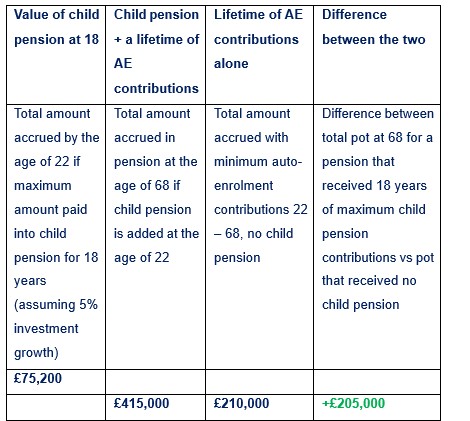

A child pension offers an alternative option for parents who are looking to put money away for their children to access much later in life. Unlike JISAs, where children can access the money at 18, they won’t be able to access it until pension age, meaning their pension pot is given an early boost. Standard Life analysis finds that if the maximum amount possible (£3,600 taking tax relief into account) was paid into a child pension for 18 years from birth, it could build a total pot of £75,200 by the time the child entered the workforce at the age of 22.

The analysis highlights just how much of an impact this can have by retirement age, as someone who began working with a salary of £25,000 a year and paid the minimum monthly auto-enrolment contributions (5% employee, 3% employer) from the age of 22, could have a total retirement fund of £210,000 by the age of 68, allowing for 2% inflation over the period*. However, starting with a maximum child pension can provide someone with as much as £205,000 more in their pension pot at the age of 68:

*assuming 3.50% salary growth per year after the age of 22, and 5% a year investment growth. Figures allow for 2% inflation. Annual Management Charge of 0.75% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied.

Mike Ambery, Retirement Savings Director at Standard Life said: “Junior ISAs and child pensions are both great ways for families save for their children’s future. JISA’s provide a tax-efficient way to save for adulthood, while children’s pensions are great for those playing the long-game as they will benefit from decades of compound investment growth. Clearly many people are utilising JISAs, and while the majority of accounts hold under £25,000, there are over 400 JISAs with very significant balances exceeding £100,000. This demonstrates the potential for JISAs to grow into substantial sums over time, especially when contributions are made consistently and investments are given time to mature. As children gain access to their JISA funds at 18, it’s important for parents to ensure their children understand the value of saving and making informed financial decisions before committing a vast amount of cash. Prioritising financial education from an early age can help young people manage these funds wisely when the time comes. For those wanting to take a longer-term approach, a child pension offers a structured way to build wealth over time, potentially more than doubling the eventual value of the child’s workplace pension pot. The right savings choice depends on individual goals, but starting early and building good financial habits can make all the difference.”

Mike Ambery compares the key attributes of a child pensions and Junior ISAs:

How do JISAs and child pensions work?

“A JISA is a child’s savings account which can be stocks and shares or cash. They have an annual allowance of £9,000. A child pension is a scheme set up for anyone under 18. You can pay up to £2,880 each financial year into a child pension, but – unlike with a Junior ISA - eligible contributions receive a 20% boost from the government even though your child is not yet a taxpayer. This means if you pay in the maximum annual amount of £2,880, then £3,600 is invested.

Who can pay into them?

“Only parents or a guardian with parental responsibility can open a Junior ISA for under 16s, or a child pension for under 18s. Children aged 16 and 17 can open their own Junior ISA. Once the JISA or child pension has been set up, anyone can contribute, including parents, grandparents, friends, and relatives.

When can a child access their funds?

The child can take control of the JISA at age 16, however, funds cannot usually be withdrawn before age 18. A child can take control of their pension plan from age 18, at which point they can make any decisions themselves, such as where they want their pension contributions to be invested, but the funds cannot be touched until they reach minimum pension age (57 from 2028).”

|