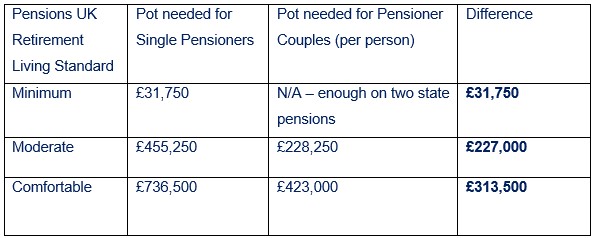

Single pensioners need to save £31,750 on top of their state pension to meet Pension UK’s ‘minimum’ standard, while couples with two full State Pensions would not need any additional savings to reach the same level

Valentine’s Day is a moment to celebrate love and commitment, but beyond the flowers and cards, new analysis from Standard Life highlights a striking financial reality - being part of a couple can offer meaningful advantages in retirement. While pensioner couples can share living costs and combine savings, single retirees must shoulder every expense alone, creating a potential £227,000 gap in the savings needed to achieve a moderate standard of living.

The cost of being single in retirement

At a moderate standard of living - which includes a car and one two-week foreign holiday a year - single retirees require an after-tax income of £31,700 a year, according to Pensions UK. Assuming receipt of the full state pension (£11,973 a year), this leaves an annual income shortfall of £24,509.50. One way to generate an income in retirement is through an annuity, which converts pension savings into a guaranteed income for life. To secure this income through an RPI-linked annuity - which provides inflation-proofed payments - a retiree would need to have built up around £455,250 in retirement savings at current rates.

By contrast, pensioner couples need a combined after-tax income of £43,900 a year to achieve the moderate living standard. With two full state pensions assumed, this could be achieved with a joint pension pot of £456,500 at current rates - funding two annuities of £228,500 each, almost half the amount required by a single pensioner.

The gap is also evident at the minimum standard of living, which covers basic needs and a one-week UK holiday each year but no car. Single retirees need an after-tax income of £13,400 to meet this level, requiring an annuity paying £1,634.50 a year and savings of around £31,750 after taking the full State Pension into account. Couples, however, need £21,600 a year to reach the same minimum standard, which would be covered by two full State Pensions.

At the comfortable level - which includes a more luxurious foreign holiday, regular home upgrades and a £1,500 annual clothing budget - the disparity widens further. a single pensioner would need to accumulate around £736,500, compared with £846,000 for a couple (£423,000 each), leaving a single retiree needing an additional £313,500 to achieve the same lifestyle.

The MoneyHelper annuity tool was used to reveal the pension pots needed to secure the PLSA’s ‘minimum’, ‘moderate’ and ‘comfortable’ standard of living in retirement.

Retirement savings needed for single pensioners and pensioner couples to secure an annuity – guaranteeing an income for life:

* Figures assume retirement at the age of 66, single life annuity, no guarantee, paid monthly in arrears, linked to RPI, non-smoker with no underlying health conditions. Account for tax free income up to Personal Allowance and then income taxed at 20%. More detail in notes.

Mike Ambery, Retirement Savings Director at Standard Life, part of Phoenix Group said: “The benefits of being in a couple extend far beyond receiving a rose on Valentine’s Day. Whether single by choice or by circumstance, the financial reality is that retirement costs are very different for those living alone. Housing, household bills and everyday expenses rarely halve simply because someone is on their own, meaning single retirees typically need to save far more to fund the same lifestyle.

“Planning ahead and taking action early can make a real difference. Pensions UK’s Retirement Living Standards are a helpful starting point for understanding the lifestyle you want in later life, while reviewing savings regularly and increasing contributions where possible - for example after a pay rise or bonus - can help build resilience over time. It’s also important to remember that life doesn’t always turn out as expected. It’s worth those in a couple today ensuring they’re well prepared for retirement, including in scenarios where they may be managing their finances alone.”

|