Analysis of the latest data from the Financial Conduct Authority (FCA)1 by retirement specialist Just Group finds that the proportion of escalating and enhanced Guaranteed Income for Life (GIfL) products (annuities) purchased has risen significantly.

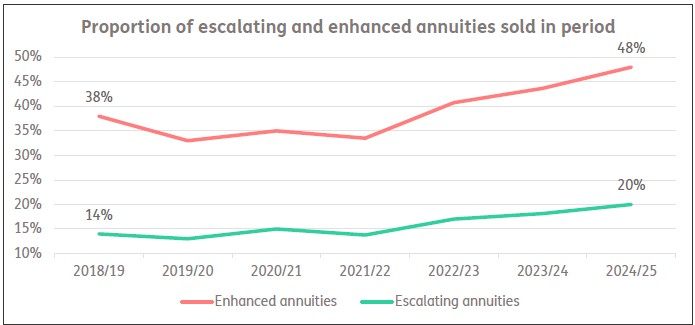

In 2024/25, 17,427 escalating GIfL products were purchased – an increase of 17% compared to 14,898 in 2023/24. Escalating GIfL products now account for a fifth (20%) of total sales, 6 percentage points higher than 2018/19 (14%).

Opting for escalating guaranteed income for life solutions protects pensioners against inflation, as rather than providing a fixed income, it starts at a lower level but rises over time either through a link to inflation or at a pre-agreed percentage increase.

The proportion of enhanced guaranteed income for life solutions has also risen noticeably in recent years with 42,339 sold in 2024/25, an 18% increase from 2023/24 (35,826). Enhanced guaranteed income for life solutions now account for almost half (48% in 2024/25) of total sales, an increase of 10 percentage points compared to 2018/19 (38%).

The FCA data on enhanced GIfL products accounts for those underwritten on medical or lifestyle factors (e.g. smoking) which typically provide an uplift in the rate available compared to non- medically underwritten products and deliver a higher level of income.

Stephen Lowe, group communications director at Just Group, said the figures were evidence of better informed decision making by customers: “It is good to see more customers tailoring Guaranteed Income for Life products to suit their personal circumstances, often securing a higher level of income in the process. Our own analysis suggests around two-thirds of GIfL customers could be eligible for enhanced rates so we are slowly nudging towards a situation where the majority of customers are benefiting from the best rate available to them. The shockwaves of the inflation spike following the pandemic may be influencing customers’ decisions when purchasing Guaranteed Income for Life, with a notable uptick in escalating plans being purchased. It’s important customers think carefully about the type of annuity they purchase – once the decision has been made it can’t be undone.”

He recommends all retirees should take the free, independent and impartial guidance from the government-backed Pension Wise service. Professional annuity brokers or financial advisers can help customers choose options and compare between providers to secure the most suitable product and best rate.

|