Steven Cameron, Pensions Director at Aegon, comments: “Nudging individuals to consider contributing more to their pension at certain points across their life is a good idea, and we have seen reduced expenditures during the pandemic prompting many individuals to increase contributions alongside increased savings. But we must avoid sending out any message suggesting it’s OK for younger workers to delay thinking about pensions until later in life. While retirement may seem far off for this group, it’s the contributions paid at younger ages which have longest to benefit from compound investment growth. It’s also risky to assume that earnings will necessarily rise or financial pressures disappear later on in life. Many younger people are taking longer to get on the housing ladder and having families at a later stage, which could mean their financial pressures could extend well into their 50s or even 60s. If earnings don’t rise and expenses don’t fall with age then reducing or delaying pension saving in youth risks individual falling far short in retirement.

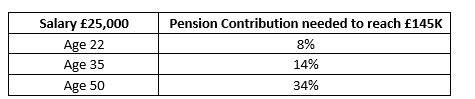

“Aegon analysis shows that an employee aged 22 earning £25k per year could build a pension fund of around £145k in today’s money terms at age 67 at the auto-enrolment minimum level of 8%. To achieve this same fund value starting pension saving at age 35, you would need a total contribution of 14%, almost double. What’s more, for most people, simply paying the auto-enrolment minimum of 5% with a 3% employer contribution will still fall far short of maintaining their lifestyle in retirement.”

Aegon analysis: 3% wage growth, 4.25% investment growth incl. charges. £145k figure is in today’s money terms adjusting for 2% inflation.

The value of investments may go down as well as up and investors may get back less than they invest.

When should individuals save for retirement?

|