A recent survey, carried out by Momentum Pensions, suggests that 63 per cent of advisers specialising in pensions are concerned or very concerned about the ongoing viability of some clients’ defined benefit (DB) schemes.

They could instead be reading First Actuarial’s Best estimate (FAB) Index, which improved again in June, showing a month-end surplus of £301bn across the 6,000 UK defined benefit schemes.

Scaremongering also ignores the protection provided to DB schemes by the Government’s Pension Protection Fund (PPF) which recently reported an increased funding level in its latest accounts of 131% (up from 116% in the previous year).

First Actuarial partner, Rob Hammond warns: “We’ve long warned of the dangers of scaremongering about the financial position of DB pension schemes. Suggestions that the recent surge in DB transfers may be due in part to advisers’ concerns on DB solvency are extremely worrying, and could lead to the next pensions mis-selling scandal.”

Hammond adds: Our FAB Index shows that the 6,000 DB schemes in the UK have a healthy surplus (calculated on a best estimate basis). Solvency has generally been increasing month on month as employers plug prudent funding deficits. We also have, of course, the safety net provided by the Pension Protection Fund which itself has a substantial FABI surplus. Advisers who exaggerate the implications of funding deficits, or ignore the existence of the PPF, risk claims of mis-selling from their clients in years to come.”

The technical bit

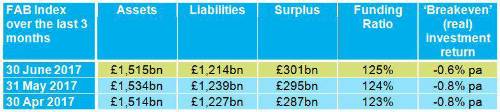

Over the month to 30 June 2017, the FAB Index improved, with the surplus in the UK’s 6,000 defined benefit (DB) pension schemes increasing from £295bn to £301bn.

The deficit on the PPF 7800 index also improved over June from £232.3bn to £186.2bn.

These are the underlying numbers used to calculate the FAB Index.

The overall investment return required for the UK’s 6,000 DB pension schemes to be 100% funded on a best-estimate basis – the so called ‘breakeven’ (real) investment return – has remained at around minus 0.6% pa. That is, a nominal rate of just 3.0% pa.

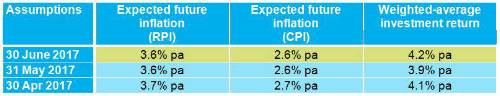

The assumptions underlying the FAB Index are shown below:

|