With self-employment on the rise and more people choosing to work for themselves, new analysis from Fidelity International’s (‘Fidelity’) ‘No Boss, No Pension’ campaign reveals that too few are preparing financially for the future, leaving billions of pounds in pension tax relief unclaimed each year. This comes at a time when the Autumn Budget has tightened finances for many self-employed workers, making tax-efficient saving even more important.

The hidden cost of under-saving: four extra years of work for the self-employed

The UK’s self-employed workforce has grown by almost a million over the past 20 years, rising around 1% a year on average. Yet while employees benefit from automatic enrolment, the self-employed must set up and manage pensions themselves, - and most don’t.

With self-employed pension participation falling from around one in three (30%) to one in five (20%) over the past decade, analysis from Fidelity highlights the growing self-employment pensions gap.

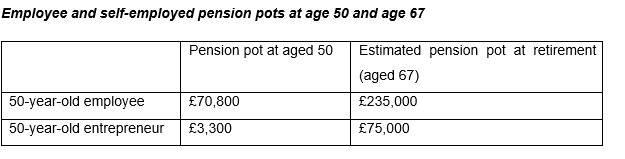

Figures from the Office for National Statistics (ONS) indicate that the average employee aged 45–54 has a pension pot worth £70,800, compared with just £3,300 for a self-employed worker of the same age.

Fidelity calculates that this imbalance could force the self-employed to work for four years longer than employees to achieve the same income in retirement4.

A 50-year-old employee with £70,800 in their pension could retire at the state pension age of 67 with a pot worth around £235,000. This assumes an annual income of £40,000, with 8% contributed to a pension each year until retirement. With the full state pension, this could provide an annual income of around £25,000, lasting to age 100.

However, for a 50-year-old self-employed worker starting with £3,300 and contributing the same 8% of income, the outcome is far less comfortable. By age 67, their pension pot would reach only around £75,000. Even allowing for the state pension, this shortfall means that they would likely need to work an additional four years - until age 71 - to build a pot large enough to sustain the same £25,000-a-year retirement income without running out of money.

Marianna Hunt, Personal Finance Specialist at Fidelity International, comments: “Britain’s entrepreneurs are the backbone of our economy, but when it comes to preparing for retirement, many are missing out on billions in free money from the government. Pension tax relief is one of the most generous incentives available, yet many of the self-employed are missing out on the opportunity to receive it.

“While the Budget introduced changes that affect how some business owners pay themselves, the core incentives for personal pension contributions remain untouched. For many self-employed workers, these will continue to be the most reliable and tax-efficient way to build long-term financial security.

“Unlike employees, the self-employed don’t have auto-enrolment prompting them to save, and irregular income can make it harder to commit. But the impact is stark. Our analysis shows a self-employed worker may need to work four years longer than an employee to achieve the same retirement income.”

Billions left on the table

This under-saving also means entrepreneurs are missing out on one of the biggest benefits available to UK savers: pension tax relief.

Fidelity’s analysis of data from HM Revenue & Customs (HMRC) shows that in the 2023/24 tax year, self-employed workers claimed just £1 billion of the £49.8 billion in total income tax relief on pension contributions5. That means self-employed savers are receiving only 2p of every £1 of pension tax relief, despite making up around one in eight UK workers (13%)6. However, even modest, regular contributions by entrepreneurs to their pensions will be generously topped up by the government, helping to build long-term financial security.

Marianna Hunt continues: “The good news is that even small steps can make a huge difference. Our ‘No Boss, No Pension’ campaign highlights the ways in which entrepreneurs can plan - giving themselves the freedom to dial down on work how and when they want in later life. Starting to save now, taking advantage of tax relief, and increasing contributions gradually can help self-employed savers close that gap and build long-term financial security without having to give up the independence they value. It’s easy to think ‘my business is my pension and I’m investing in my business’, but not having formal pension savings could leave entrepreneurs vulnerable to financial shocks, especially if illness stops them from working or they find their business is not easy to sell later on.”

Fred Hicks, Senior Policy Advisor at IPSE, the self-employed trade body, said: “These are stark findings for the self-employed and proof that getting to grips with your pension today – not tomorrow – can save you years of time.

“When you’re focused on your business, it can feel tricky to dedicate the time to thinking about retirement, especially when it’s a long way off. But this campaign shows that there are actually small things the self-employed can do to start changing that and get in the habit of checking in on your pension.”

Fidelity says it is never too late for the self-employed to build a more secure financial future. A few simple steps can make a significant difference.

Open a Self-Invested Personal Pension (SIPP): A SIPP allows self-employed workers to make flexible contributions and choose how their money is invested. Every contribution automatically receives 20% tax relief, with higher-rate taxpayers able to reclaim up to 40% through self-assessment. Even small, regular payments can grow substantially over time.

Use the “carry forward” rule: If you haven’t used your full pension allowance in previous years, you may be able to contribute unused amounts from the past three tax years.

Contribute through your business: If you operate as a limited company, employer pension contributions can be offset against corporation tax, making them highly efficient for retirement saving.

Make contributions regular and manageable: Setting up a monthly direct debit helps maintain consistency, even when income varies. Regular investing also smooths out market volatility over time.

Consolidate and review: Bringing old pensions into a single SIPP can reduce fees and make it easier to track progress. Review your investments annually to ensure they match your goals and risk tolerance.

For more information, visit: www.fidelity.co.uk/self-employed-pensions

|