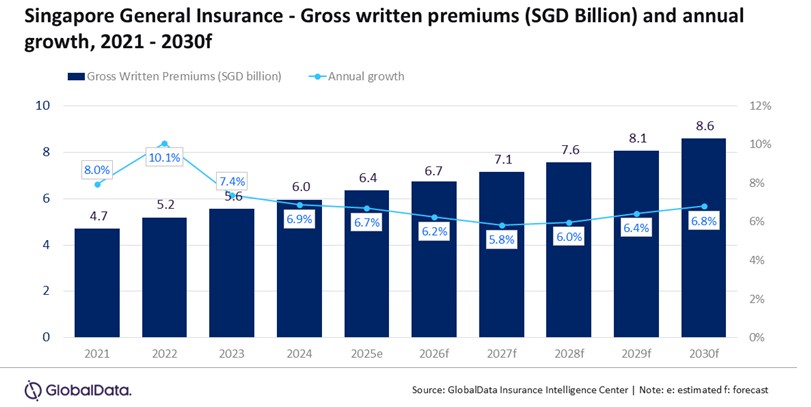

Singapore general insurance industry to surpass $8 billion in 2030, forecasts GlobalData

According to GlobalData’s Global Insurance Database, the general insurance market in Singapore is estimated to register an annual growth rate of 6.7% in 2025, driven by economic expansion, rising demand for health insurance products, rising auto insurance premiums, and resilient property values. Personal accident and health (PA&H), motor, property, and liability insurance combined are expected to account for 81.3% of the general insurance GWP in 2025.

Swarup Kumar Sahoo, Senior Insurance Analyst at GlobalData, comments: "Robust growth in Singapore’s general insurance is supported by growing demand across core lines of business. Motor insurance premiums are expected to rise due to elevated claims costs. While medical inflation, an aging population, and the launch of new products such as embedded health insurance plans and youth-focused accident cover will boost PA&H demand, resilient property prices and ongoing infrastructure investment will keep the growth of property insurance upward during 2026-30.”

PA&H insurance is the largest line of business and is expected to account for 24.7% of the general insurance GWP in 2025. During 2021-25, this line grew at a robust CAGR of 15.7%. The strong growth is attributed to rising healthcare spending and an aging population. According to the Life Insurance Association of Singapore, as of H1 2025, around 72% of the Singapore population has Integrated Shield Plans, which remain a vital component for health insurance coverage.

According to the Department of Statistics Singapore, medical inflation reached 10.1% in 2024. High cost due to the adoption of new medical technologies, little or no cost sharing, and advancement in pharmaceuticals are the contributing factors. Rising healthcare expenditure is supporting the demand for more inclusive health benefits in group health insurance plans.

According to the National Population and Talent Division, the proportion of the population aged 65 years and above increased from 13.1% in 2005 to 20.7% in 2025. Based on this, every 1 in 5 people in Singapore will be 65 years and above at the end of 2025. These factors are expected to support the growth of PA&H insurance, which is forecasted to grow at a CAGR of 7.7% during 2026-30.

Sahoo adds: “Embedded and behavior-linked health insurance is gaining popularity. Such insurance products have an improved risk selection approach and have the potential to lower claims volume and value through healthier behavior.”

Motor insurance is the second-largest line of business, which is expected to account for 20.6% of the general insurance GWP in 2025 and register steady growth during 2026-30. According to GlobalData, motor insurance premium is expected to grow by 6.7% in 2025 and 6.2% in 2026, supported by the increase in premium rates and vehicle sales. During January-September 2025, vehicle sales increased by a robust 25% compared to the same period in 2024, driven by strong demand for battery electric vehicles under the government’s Electric Vehicle Early Adoption Incentive scheme.

Property insurance is the third-largest line of business with an estimated 19.1% share of the general insurance GWP in 2025. Investment in public infrastructure projects and growth in the housing market will support property insurance growth of 7.5% in 2025 and 6.3% in 2026. Key infrastructure projects include the expansion of the rail network by 360 kilometers by 2030, and road projects such as the Changi Northern Corridor, North-South Corridor, and Tampines Walking and Cycling Town.

Other general insurance lines, such as liability, financial lines, and MAT, are estimated to account for the remaining 34.8% share of the general insurance GWP in 2025.

Sahoo concludes: "The general insurance market in Singapore is expected to register strong growth during 2026-30. With economic tailwinds and targeted product innovation across consumer, commercial, and specialty lines, Singapore’s general insurers are well placed to accelerate premium growth while closing protection gaps and strengthening risk management disciplines."

|