The government has also confirmed that income tax thresholds will remain frozen until 2031If the government retains the triple lock, the state pension will continue to increase in line with the highest percentage increase in earnings, inflation or 2.5%The OBR set out its predictions for growth and inflation for the next five years, which indicate the state pension will in most cases continue to rise by 2.5% annually under the triple lockThe chancellor’s Budget speech confirmed pensioners whose sole income is the new or basic state pension won’t face simple assessment tax returns, but there is currently no detail on how tax will be collected

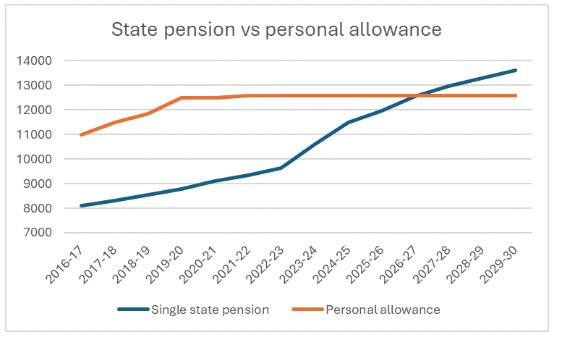

Rachel Vahey, head of public policy at AJ Bell, comments: “Amongst the flurry of tax changes announced in the Autumn Budget was the welcome confirmation for pensioners that the state pension will increase by 4.8% next April. However, this news is bittersweet. With the continued freeze in the income tax personal allowance threshold at £12,570 until April 2031 at the least, the new state pension will soon leapfrog this, meaning that from April 2027 those pensioners receiving the full state pension will have to pay tax, regardless of whether they have any additional private pension income.

“But how this tax will be collected remains to be seen. The chancellor in her Budget speech confirmed that pensioners will not be faced with the administrative hassle of simple assessment tax returns. Instead, the government intends to find a way to collect the tax from pensioners whose sole income is the basic or new state pension as part of its efforts to ‘modernise the tax system’, with further details to be outlined next year.

“Collecting the little bits of tax owed from millions of pensioners was always going to be an administrative headache for the government. So it’s no wonder they’ve put their tax collecting thinking caps on to find ways to avoid it. But we will have to wait and see what process they come up with and whether it will indeed make pensioners’ lives simpler.”

Leapfrogging the frozen personal allowance

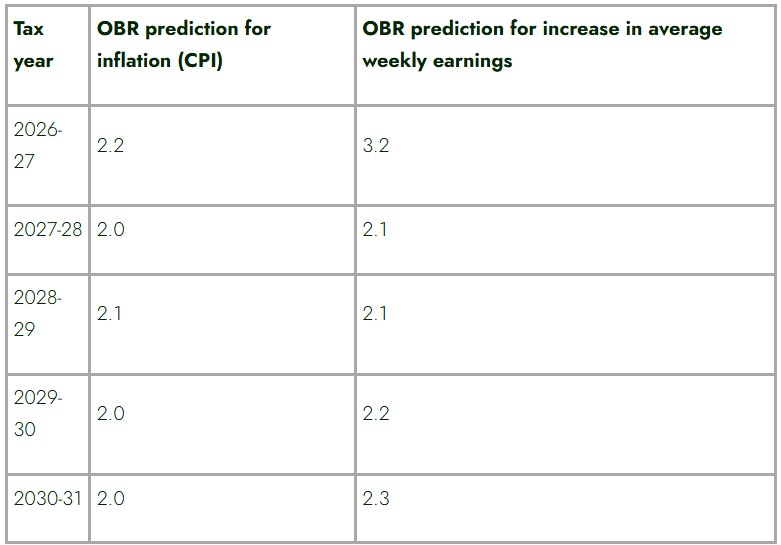

“The Office for Budget Responsibility has set out its predictions for growth in prices and earnings over the next few years, with both inflation and wage growth mainly expected to be below the minimum 2.5% anchor of the triple lock guarantee.

Source: OBR: Economic and fiscal outlook – November 2025

“If true, this means the state pension will increase by 2.5% for each year up to April 2031, except for the increase in April 2027 which will be in line with the higher rate of earnings growth.”

Source: AJ Bell, HMRC. *Annual figures based on weekly state pension multiplied by 52 to provide a rough estimate.

The Pensions Commission and the future of the triple lock

“In July, the government revived the Pensions Commission as part of a long-term plan to address the pension under-saving crisis of those due to retire in the mid-century. As part of this, the commission will look at the relative success of automatic enrolment, contribution rates among employers and workers and solutions for the self-employed. But the Commission also promises to look at the balance between all types of pensions, and that could mean a review of the state pension as well, at the same time as the government undertakes its formal review of the state pension age.

“The state pension age will gradually increase to age 67 between 2026 and 2028. It’s also due to rise to 68 in the mid-2040s. The latest state pension age review will look at whether the current rules for setting when people can start receiving their state pension still make sense, given new information on life expectancy and other important factors. A new framework of rules could hasten conversations on whether to bring forward an increase in the state pension age to the late 2030s to save future governments money.

“Pensions minister Torsten Bell recently ruled out scrapping the triple lock guarantee, but as the state pension grows ever closer to the frozen personal allowance threshold it could be that the government is finally forced to address the question of how much the state pension should really offer, at what age, and how it can increase payments sustainably each year.”

|