|

|

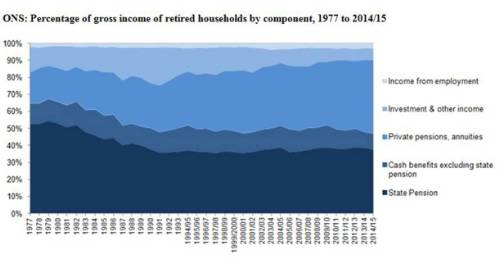

Kate Smith, Head of Pensions, Aegon: “The latest ONS statistics show that the State pension and state cash benefits now account for less than half the income of retired households. On the surface, this might look like encouraging news that people are making more personal provision for a more comfortable retirement. |

• Aegon warns that future generations will face a difficult challenge to match current retirees’ levels of prosperity

• Overall proportion of income for retired households coming from the State, has fallen from 64.7% in 1977 to 47.1% in 2014/15

But it’s not a cause for complacency for those of working age saving for retirement. The current generation of retirees are benefitting from private pensions they built up with gold-plated defined benefit pensions and favourable tailwinds such as decades of rising house prices, economic growth as well as the Triple Lock state pension.

“With the working population’s incomes stalling and the decline of generous defined benefit pensions, this isn’t likely to be the case for people retiring in ten years’ time unless there is a fundamental change in savings behaviour. Every generation aspires to have a better financial future than the previous generation but this will not continue unless people make adequate pension savings and start saving as early as they can. To build up an amount equivalent to the State pension you need to have private pension savings of around £200,000.

“The median income for retired households is £21,000 a year (2014/15), well below the median income for non-retired households of £28,300 a year. But since the economic downturn in 2007, retired households’ median income has increased by £1,500 on top of inflation compared to a fall of £900 for working households. This is clearly an intergenerational issue, as the next generation to retire is less likely to benefit from a combination of a generous State pension increases and gold-plated defined benefit pensions.”

To download the full document please click on the document below

|

|

|

|

| Pricing Transformation Lead | ||

| London - £85,000 Per Annum | ||

| Lead Capital Actuary | ||

| London - £150,000 Per Annum | ||

| Take the lead on capital oversight | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Be at the forefront of creative GI co... | ||

| London/hybrid 2-3dpw office-based - Negotiable | ||

| Remote Market and Credit Risk Calibra... | ||

| Remote - Negotiable | ||

| Contact us about a Capital Contract i... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Head of Insurance Risk | ||

| London - £160,000 Per Annum | ||

| Director - Pensions Risk Transfer (PRT) | ||

| London, Midlands, North West - hybrid working 2dpw in the office - Negotiable | ||

| Dip a toe into public sector work wit... | ||

| Flex / hybrid 2 days p/w office-based - Negotiable | ||

| P&C Consultant | ||

| London / hybrid 3dpw office-based - Negotiable | ||

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.