Mike Ambery, Retirement Savings Director at Standard Life, part of Phoenix Group said: “New ONS average earnings figures show a rise of 4.7% and are significant for state pensioners, as they're set to determine next April’s state pension uplift under the triple lock rather than September inflation - which is forecast to peak at 4%. The mechanism guarantees that the state pension rises by the highest of average earnings growth, September’s inflation, or 2.5%. “With the government holding fast on its commitment to the triple lock, it looks likely that the 2025-26 full new state pension will be at least £12,534.60, up £561.60 on this year’s payment.

State pension and the personal allowance

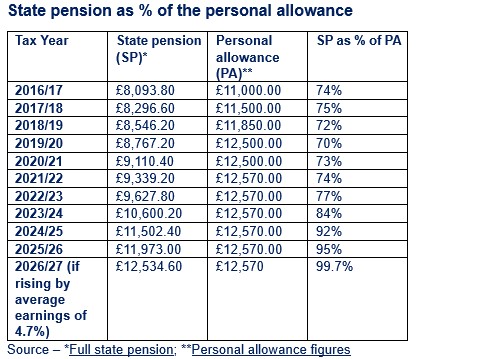

“The planned uplift will be some comfort for pensioners grappling with rising bills and the lingering effect of inflation on everyday essentials. However, a full new state pension of £12,534.60 will also be over 99% of the personal allowance, currently frozen at £12,570 until 2028 – by contrast, in 2021/22 the new state pension was equivalent to 74% of the allowance. This means pensioners will need just £35.40 of other income before paying income tax. The personal allowance rose fairly rapidly as a percentage of average earnings in the just over a decade before 2020, from 23.61% in the 2007-2008 tax year to just under 45% in 2020. Since 2020, a combination of freezes and inflation has seen this decline meaning a greater percentage of income is taxable. For pensioners paying the higher rate of tax, the value of the £561.60 rise will be eroded to around £337.”

Sustainability of the state pension

“While the triple lock continues to offer protection, questions around the long-term sustainability of the state pension persist in light of rising life expectancy and a squeezed public purse. Options to boost affordability include abolishing the triple lock, raising the state pension age faster or higher than planned or introducing an element of means testing – all of which would prove very controversial.”

David Brooks, Head of Policy at Broadstone, said: “Today’s earnings figures point to another substantial triple-lock increase next April, taking the full new State Pension right to the brink of the Personal Allowance. The Bank of England forecast in August that UK inflation would peak in the UK at 4% so it appears likely that today’s earnings figures will deliver around a £563 rise in the State Pension next year, taking it to £12,536 for 2026/27. The good news for millions of pensioners is that they will receive hundreds of pounds more income every year at a time when many still face persistent cost-of-living pressures and depend heavily on the State Pension as their main income. At a time of strained public finances, however, the rising cost of funding this benefit will once more come under scrutiny especially given the ongoing State Pension Age Review. Debate over the future of the triple lock itself, means-testing or alternative funding, such as via the introduction of a national insurance contribution of some kind, is likely to intensify. Increasingly the debate appears to be framed as triple-lock or nothing when it comes to increasing the State Pension. But most would consider it fair that the State Pension should increase and the Government has repeatedly committed to it for the remainder of this Parliament. The debate should be around whether the increase is dictated by an earnings link or an inflation link should be a priority. Sustaining the State Pension is a political choice but, for now, one which remains political too difficult to address.”

|