Steven Cameron, Pensions Director at Aegon comments: “The government’s commitment to maintaining the state pension triple lock will offer some good news in a difficult climate for state pensioners as they will receive a bumper increase in state pension payments from next week.

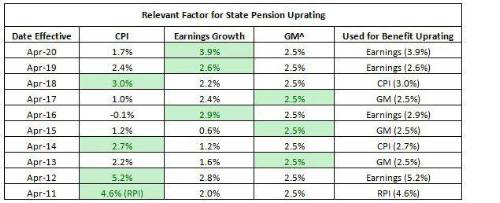

“Under the triple lock, the state pension has been rising at the highest of earnings inflation, price inflation or 2.5% a year. This year, the state pension will be uprated against earnings growth of 3.9%, the highest of these benchmarks and over double the rise in inflation-linked benefits and tax credits. This means that those who reached state pension age after 6 April 2016, and are entitled to the full New State Pension, will see their weekly payments rise next week from £168.60 to £175.20. Those who reached state pension age before then, and are receiving the full Basic State Pension, will see payments rise from £129.20 to £134.25. Some in this group will also be receiving a state earnings related pension.

“At the present time, with many people including pensioners facing financial difficulties to cover their basic expenses, any extra however little helps and this inflation-busting increase offers state pensioners some much needed good news.”

* https://commonslibrary.parliament.uk/research-briefings/cbp-8806/

Aegon analysis of DWP State Pension Benefits Uprating

^Guaranteed Minimum of 2.5%

|