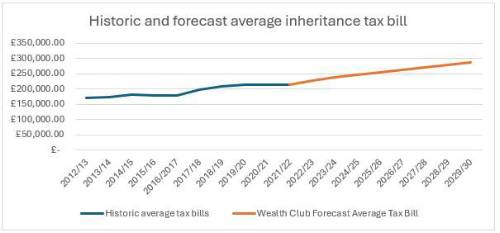

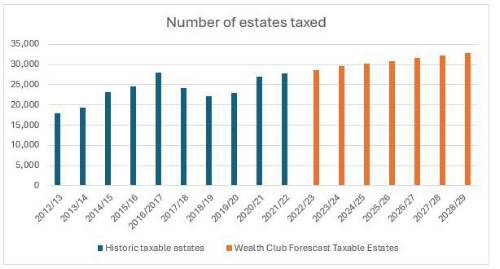

Wealth Club estimates suggest these trends are likely to continue with the average IHT bill reaching £248,000 in the current tax year (2024/25), spread across 30,300 estates, up 15.3% and 6.5% respectively

Data available here.

Nicholas Hyett, Investment Manager at Wealth Club, commented: “Rising property prices and savings built up over the pandemic, together with frozen inheritance tax thresholds, continues to drive increases in the number of people paying inheritance tax. An average bill of £215,000, is already eyewatering, but Wealth Club research suggests it could hit £248,000 in the current tax year and nearly £290,000 by the end of the decade if the current rules remain unchanged.

It’s tempting to see inheritance tax as a problem restricted to the mega wealthy, since only around 1 in 24 deaths result in an inheritance tax charge. However, not only is the number of people facing this most hated of taxes growing all the time, but that number is probably misleadingly low. Since spouses can pass assets between each other without creating an inheritance tax liability, the number of couples generating a liability on the death of the second partner is probably significantly higher. The result is that more like 1 in 14 families will ultimately face an inheritance tax bill.

IHT is one of the few large taxes the government hasn’t explicitly promised not to change. That’s made it something of a political hot potato, and led to suggestions it could be a candidate for a hike. The reality though is that the government doesn’t need to change anything to increase its IHT harvest, it can just let frozen tax bands do their work. That will result in ever more families being dragged into the IHT net, and those that already pay see their tax bills rise. All without a spending a penny of political capital. Stealth taxes strike again.”

|