The proportion of people shopping around to secure the highest income from Guaranteed Income for Life (GIfL) solutions, otherwise known as annuities, has reached record highs since pension freedoms amid a surge in annuity rates.

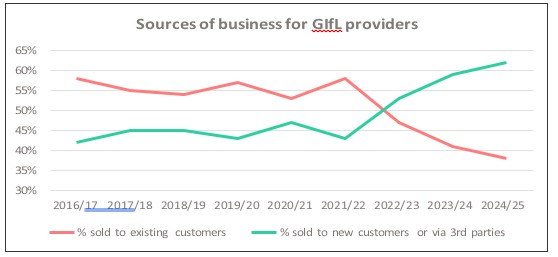

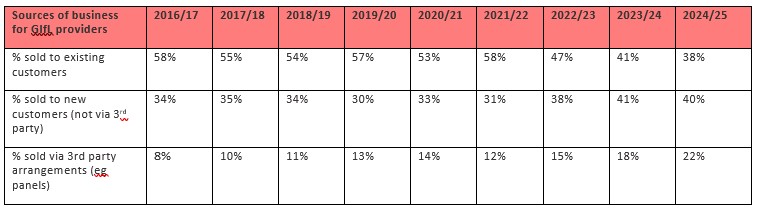

Analysis of the latest FCA’s Retirement Income Market Data by retirement specialist Just Group finds that the proportion of GIfL products purchased by customers from their existing provider fell to 38% in 2024/25, down from 41% in 2023/24, 47% in 2022/23 and 58% in 2021/22.

Overall, 62% of annuities in 2024/25 were purchased by customers after shopping around for the best rates either themselves (40%) or via professional brokers or advisers (22%), up from 59% the previous year and 53% in 2022/23. Among annuity buyers with pensions worth £50,000+ the proportion switching providers was higher still at 68%.

Sticking with their existing provider puts customers at risk of missing out on better rates available elsewhere on the market. The difference between the highest and lowest paying annuity for a healthy 65-year-old with a £50,000 pension is about £362 a year at current rates, equivalent to £9,050 over a 25-year retirement. Nearly half (48%) of annuity buyers received enhanced rates after disclosing health and lifestyle information.

Stephen Lowe, group communications director at retirement specialist Just Group, said: “It is great to see that more customers are shopping around themselves or using advisers and brokers to compare rates. We estimate that about three-quarters of pension money used to buy annuities is going through the open market, which is the only way people can ensure they are finding the most competitive rates on offer.

“The statistics hint that the rules introduced in 2019, which obliged pension providers to show existing customers how their own Guaranteed Income for Life quote compared with the best available on the open market, are bearing fruit. The initiative was designed to help customers spot easily how much they might gain from shopping around and encourage people to switch provider to get the best deal. It’s brilliant to see shopping around become the norm because it means more money in people’s pockets every year for the rest of their lives.”

He said people using pension savings to buy a Guaranteed Income for Life solution should:

• Understand your own provider may not offer you the best deal on the market.

• Take up their entitlement to a free appointment with the government’s independent and impartial guidance service Pension Wise to help understand how to make the most of their pension savings.

• Where their existing pension company does not offer a broking service, consider using an independent service or a regulated financial adviser who will work on your behalf to find the best deal and most suitable solution for your circumstances.

• Ask your pension company if their GIfL quote takes into consideration medical and lifestyle information, which can significantly increase retirement income.

|