There’s a huge cost of being single in retirement according to new analysis from Standard Life, part of Phoenix Group. While couples can pool their savings and share expenses, couples must foot the bill alone – leading to a potential £225,000 difference in the savings needed to achieve a moderate standard of living in retirement.

Single retirees who want to achieve a minimum living standard, which includes enough for the basics and one week’s holiday in the UK a year but no car, would require an annual income after tax of £14,400 according to the PLSA1. Assuming a full state pension (£11,973 a year2) is received, a retiree needs an additional income of £2,884 taking account of tax each year to maintain this standard of living. To buy an RPI linked annuity - which is a guaranteed income for life - they would need to have amassed around £54,5003 in retirement savings at current rates. In comparison, pensioner couples need an annual income of £22,400 to reach the same standard of living, however this would be covered by two full state pensions meaning they would not need to have accumulated any additional savings to cover a basic retirement lifestyle.

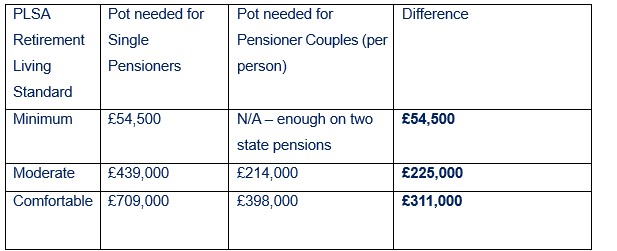

The MoneyHelper annuity tool was used to reveal the pension pots needed to secure the PLSA’s ‘minimum’, ‘moderate’ and ‘comfortable’ standard of living in retirement.

If you’re seeking a moderate retirement standard of living, which allows for a car and one two-week foreign holiday a year, the PLSA say single pensioners need an after-tax income of £31,300 per year. Assuming a full state pension is received, they would need an annuity which provides £24,010 a year, taking account of tax. To achieve this, they would need to save around £439,000. Pensioner couples, meanwhile, need an annual income, after tax of £43,100, which they could get if they also amassed £428,000 in their joint pension pot, meaning they would need to save £214,000 each – nearly half the amount of a single pensioner, assuming two full state pensions being received.

For a comfortable living standard in retirement, which allows for a three-week foreign holiday, a full kitchen and bathroom replacement every 10-15 years and a £1,500 a year clothing and footwear budget, single pensioners would currently need to accumulate a pot of around £709,000. Pensioner couples would need £709,000 between them, or £398,000 each – meaning a single pensioner would need to save £311,000 more that their couple peers to achieve the same lifestyle.

Retirement savings needed for single pensioners and pensioner couples to secure an annuity – guaranteeing an income for life:

* Figures assume retirement at the age of 66, single life annuity, no guarantee, paid monthly in arrears, linked to RPI, non-smoker with no underlying health conditions. Account for tax free income up to Personal Allowance and then income taxed at 20%. More detail in notes.

Mike Ambery, Retirement Savings Director at Standard Life, part of Phoenix Group said: “Whether single by choice or by circumstance, solo living comes with a financial price tag. While it seems unfair, mortgage, rent, utility bills and holidays costs don’t simply halve for those living alone. The same applies to pension savings. While couples can combine their resources, single retirees need to build up much more to achieve the same lifestyle in retirement. Let’s not forget, relationships don’t always last, and the importance of pension planning extends beyond just those who are single today. Awareness of these figures can help when considering pension sharing in divorce settlements or preparing for a potential single retirement. It’s important to take control of your future financial happiness whether you’re single or in a relationship. Starting early, making regular contributions, and topping up savings where possible can make a real difference.”

|