“While AIM’s 30th anniversary has been clouded by talk of how the market is shrinking fast, there are still reasons to celebrate its achievements. A good chunk of AIM’s original members have gone on to score a winning goal for investors’ portfolios,” says Dan Coatsworth, investment analyst at AJ Bell.

“Eleven companies that joined AIM in its first six months of existence are still on the UK stock market today. A couple have been promoted to the premier league, namely insurer Hiscox, which is now a FTSE 100 company, and genetics group Genus which has ascended to the ranks of the FTSE 250. Anyone who bought Hiscox at its AIM IPO would have subsequently enjoyed a 2,650% total return, which factors in share price gains and dividends. Investment trust Athelney Trust also made the move from being an AIM early bird to joining the Main Market. AIM has been called the ‘Wild West’ in the past and has had its fair share of disasters, yet it would be wrong to call the entire market a failure. It was designed to nurture growing companies, and the achievements of Hiscox and Genus prove it has been successful.

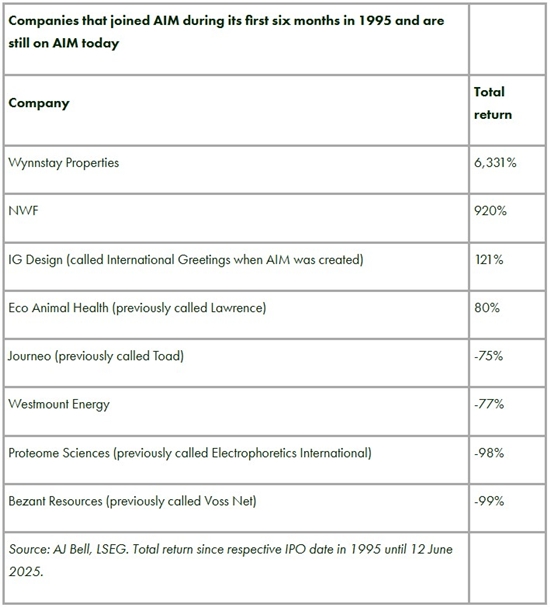

“Eight of the original 11 companies that made up the AIM market when it launched 30 years ago are still members. The best performer among those still quoted on AIM is Wynnstay Properties which has delivered a 6,331% total return. Its history lies in developing and managing residential property in London’s Kensington area, but it switched to commercial property in 1972. While the business is still relatively small compared to many real estate stocks on the London Stock Exchange, the rich returns for investors speak for themselves.

“Supplying animal feed to farmers and filling up domestic heating tanks with oil might not sound very glamourous, but it’s been a ticket to steady wealth creation for NWF. A 920% total return since joining AIM in September 1995 is not to be sniffed at. AIM has been a good place for small companies to broaden their shareholder base and tap capital markets to accelerate their growth. NWF has made various bolt-on acquisitions over the past three decades, some of which have been part-funded by issuing new shares.

“There are plenty of other examples of similar companies on AIM which are good at what they do, have carved out a market niche, and where their earnings have steadily moved higher. Those ingredients are exactly what many investors want on their menu.”

|