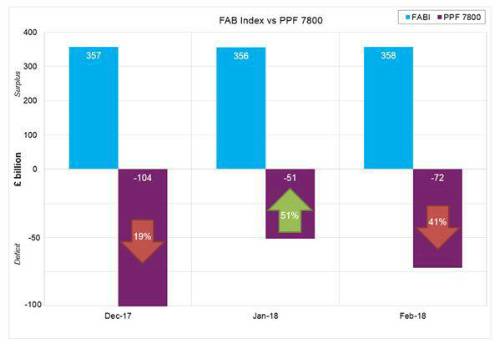

The aggregate shortfall of the UK’s 6,000 defined benefit (DB) pension schemes measured on the Pension Protection Fund’s (PPF) basis worsened by 41% from £51bn to £72bn. This followed a 51% improvement in January and a 19% worsening in December.

In sharp contrast, the FAB Index – which provides the aggregate position of the UK’s 6,000 DB pension schemes calculated using the best estimate expected return on the assets held by those schemes – remained strong over February, with a month-end surplus of £358bn, and a healthy 130% funding ratio.

First Actuarial Partner Rob Hammond said: “Last month’s PPF 7800 improvement led to one newspaper proclaiming on its front-page of a ‘Pensions boost for millions: Relief as deficits in final salary schemes halve in a month’. It’s only a matter of time before the same, usually pessimistic, newspaper declares a ‘pensions disaster’. This yo-yo effect does nothing to restore people’s confidence in pensions.”

Hammond added: “There are lots of different measures of pension scheme liabilities. The PPF 7800 Index is just one of them. The FAB Index is another. Neither of them is used to value pension schemes in company accounts, nor are they appropriate for prudent funding, which is why context needs to be given when quoting such numbers.”

The technical bit…

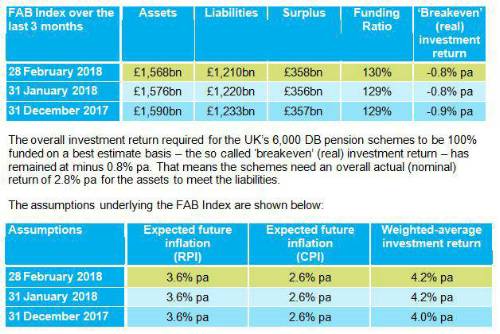

Over the month to 28 February 2018, First Actuarial’s Best estimate (FAB) Index improved slightly, with the surplus in the UK’s 6,000 defined benefit (DB) pension schemes increasing from £356bn to £358bn.

The deficit on the PPF 7800 Index deteriorated over February from £51.0bn to £72.1bn.

These are the underlying numbers used to calculate the FAB Index.

|