Surveying 2,000 UK adults, the data also uncovers a lack of diversification amongst those who do invest, highlighting a widespread lack of confidence and understanding when it comes to building diversified, resilient portfolios

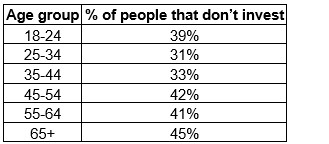

Here’s a breakdown of the percentage of people in each age group who say they don’t currently invest:

Key points from the research reveal:

• 18–24-year-olds are more cautious than expected, with nearly 4 in 10 saying they don’t invest. However, those aged 65+ are the most wary of investing.

• 25–34s are the most investment-active group, suggesting older Gen-Zs and younger millennials are becoming more financially confident.

• Those aged 65 and over are the least likely to invest despite the benefits that some lower risk investment types, such as Stocks and Shares ISAs, can have on supporting retirement funds.

• 60% of non investors say they would rather put their money into a savings account despite interest rates on savings accounts often being below inflation level.

• The top three reasons that prevent people from investing more lie in the fear of losing money, the risk associated with it, and the current rising cost of living.

• Amongst those who do invest, approximately one in 10 investors invest in stocks and shares, just 5% in mutual funds and 3% in index funds. Most prefer more common investment types such as cash ISAs, the favourite across all age groups, and workplace pensions, suggesting a lack of diversification across the UK.

• Just 12% are currently investing into a personal pension, however the data shows people are more likely to do so as they get older with almost a third (31%) of 55-64 year olds saving into one (versus just 12% of 18-24 year olds). This suggests many Brits aren’t planning their investments for retirement until later in life.

Experts at Shepherds Friendly warn that avoiding investing altogether may also mean missing out on lower-risk opportunities to grow wealth more steadily, whilst a lack of diversification for those who do invest can carry greater risk.

Below, Derence Lee, Chief Finance Officer, at Shepherds Friendly, comments on the potential impact of older generations opting out of investing, and how diversification can offer a solution:

“As people near retirement, it’s understandable they want to protect any wealth they’ve built, but it’s a common misconception that all investing is high-risk. There are options like diversified Stocks and Shares ISAs that are designed to offer more stable, long-term growth while managing downside risk. For many, these can be an effective alternative to relying solely on cash savings, which may lose value in real terms over time due to inflation.”

“Aside from this, diversification also remains a key educational gap across age groups, likely the combination of limited knowledge and a lack of investing confidence. Many people may not realise that spreading investments across different types of assets, such as bonds, shares, and funds, can reduce exposure to market fluctuations. By allocating resources across a mix of assets, investors can potentially offset losses in one area with gains in another and help to enhance overall portfolio stability.

“Bridging this knowledge gap through financial education could empower individuals to make more resilient and informed investment decisions over the long term. With the right approach and guidance, investing doesn’t have to feel daunting, it can be a powerful way to preserve and grow wealth throughout your life.”

|