By 45 men are on track for a bigger pension pot in retirement on average, even if they make no more contributions and women keep contributing 8% of their salary

Women need to contribute 22% of their salary from age 45 to match the average man by retirement age

Women need to pay in £213 per month more than men from age 45 to match their pension pot by retirement age

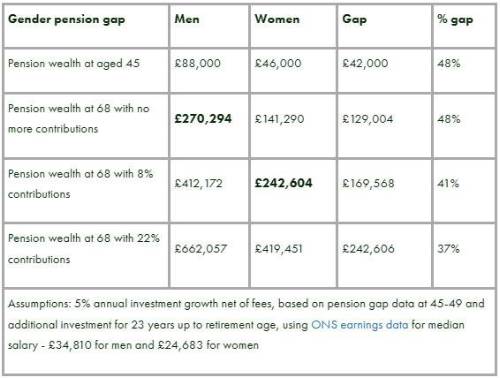

Government data on the gender pension gap reveals there is a 48% pension gap between men and women by the time they reach age 45 with men having £88,000 in their pension on average, compared to £46,000 for women. This gap is set to expand over the next few years as investment compounding and lower women’s average pay both impact on future retirement wealth.

Alice Guy, Head of Pensions and Savings, interactive investor says: “By mid-life a huge pension gap has already opened up by between men and women, and it’s an uphill struggle for women to make up the difference. Women often take time out from the workplace in their 30s and 40s to care for young children and that has a huge knock-on impact on pension wealth later on.

“It’s a double whammy for women - not only do they earn less on average, but investment compounding works in favour of those who have bigger pots in mid-life. Amounts saved in your 20s and 30s are worth their weight in gold as investment returns mean they snowball over time.

“The stark reality is that men in their 40s are already on track for a bigger pension pot in retirement even with no more contributions. And if men do continue paying in, women need to contribute a massive 22% of their salary to catch up by retirement.

“The good news is that even smaller amounts of extra pension saving make a big difference by the time it comes to retirement. Saving just £50 more each month for 30 years could add over £50,000 to your pension wealth in retirement.”

|