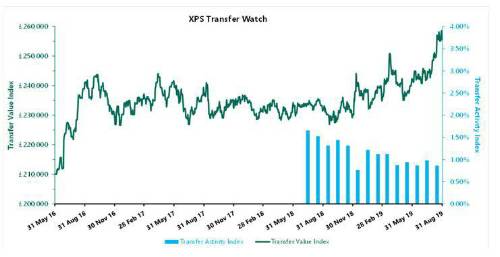

XPS Pensions Group’s Transfer Value Index jumped sharply during August, rising to £258,200 on 21 August before peaking at £258,600 on 29 August 2019. It fell slightly to £255,600 at the end of the month, up from £247,400 at the end of July 2019. The increase was largely driven by a significant fall in gilt yields during August, partially offset by a smaller fall in inflation expectations.

XPS Pensions Group’s Transfer Activity Index recorded a fall in the number transfers that the administration business processed during August, to an annual equivalent of 0.86% of eligible members, down from 0.98% in July. This is broadly in line with the rates seen in the last few months, but significantly down on the rates of 1.46% observed last August.

In market news, one of the UK’s largest pension transfer advisors, LEBC, has withdrawn from the market following a review from the Financial Conduct Authority. This unexpected news is likely to put a significant strain on the already busy market for independent financial advice.

Mark Barlow, Partner, XPS Pensions Group commented: “August was a particularly turbulent month for the financial markets which resulted in transfer values hitting all-time highs. Transfer activity has remained quite steady recently and it will be interesting to see whether current high transfer values will impact on activity over the coming months.

“However, members may find it difficult to obtain financial advice on their pension transfer. The withdrawal of one of the UK’s largest advisors from the market, together with the potential forthcoming ban on contingent charging, is likely to create an advice capacity crunch.”

|