A survey of trustees and other pension professionals from Broadstone exposes scepticism over the workability of the incoming Funding Code.

More than nine in 10 (91%) said that they did not think the Funding Code would be in force by October 2023, given the work still required and the need to reflect on the implications of the sharp change in underlying economic conditions late last year. It follows concern over how trustees would safely comply in practice given the regulations do not seem to align with the Code’s expectations in places.

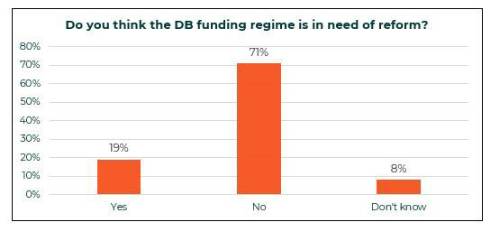

Perhaps more surprisingly, a large majority (71%) of those surveyed said that they did not think the Defined Benefit funding regime was in any need of reform. Under a fifth (19%) thought that reform was necessary with around one in 10 (8%) unsure.

Moreover, three-quarters of the survey respondents said that if the Code is laid as drafted they expected the impact to be increased pressure on Sponsors to pay higher contributions, even where the risk to members’ benefit security is low.

David Brooks, Head of Policy at Broadstone, commented: “These findings emphasise the strong concerns held in the Trustee and pensions community about the incoming Funding Code.

“Many continue to be concerned about the high hurdle that the Code imposes on schemes and sponsors for what will, in a lot of cases, appear to be very limited gain and sponsors will no doubt find further contribution requests hard to stomach given the general reports of much improved funding.

“In many ways, the responses are a back handed compliment on the work the Regulator has done over the past few years. They have discussed in their annual statement long-term targets, the integrated risk management model and focussing on situations of sponsor distress.

“This has directly resulted in good funding and investment practices being adopted by the well-advised schemes and left them now questioning the need to go further. The upshot that many schemes are having the right conversations and doing the right things in absence of a restrictive and complex Code.”

Broadstone raised concerns in its Consultation Response that the Funding Code would be specifically problematic for smaller schemes who would face disproportionate governance and cost burdens.

|