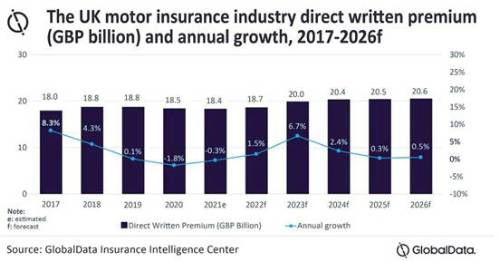

GlobalData’s latest report, ‘United Kingdom (UK) General Insurance Market, Key Trends and Opportunities to 2025’, reveals that the UK motor insurance industry will witness growth of 1.5% in 2022 and 6.7% in 2023 in terms of DWP due to the increasing cost of comprehensive motor insurance plans on the back of rising inflation, easing of COVID-19 restrictions and an increase in vehicles sales.

Bharat Khamari, Insurance Analyst at GlobalData, comments: “The motor insurance industry declined by 1.8% in 2020 in terms of DWP due to lockdown restrictions. However, the soaring inflation rate and the gradual lifting of the restrictions will help the industry to recover in 2022.”

Premium prices decreased in each quarter of 2021 due to a shift in driving habits during the pandemic.

Khamari explains: “With people working from home and fewer vehicles on the road during the height of the pandemic, there was a decrease in accidents and claims. However, motor insurance prices increased by 2% during the first three months of 2022 as lockdown restrictions were eased and more vehicles were on the road, which increased the number of accidents.”

The Financial Conduct Authority (FCA) implemented pricing reforms in January 2022, which banned insurers from charging higher prices to customers on renewal of their home or motor insurance plans. This will impact new policies and renewal policy premiums and lead to short term price volatility. If premium rates are adjusted with the rising claims and inflation, the segment may report declined underwriting results in 2022. The motor insurance industry is expected to achieve an underwriting profit with a net combined ratio (NCR) of 97% due to low claims in 2021.

Khamari adds: “Motor insurance prices are expected to increase as the industry faces high inflation and compliance costs related to FCA pricing reforms. As companies look to re-balance premiums prices for existing and new customers, it would result in a jump in the DWP in 2023.”

|