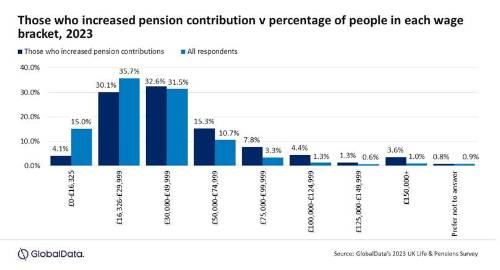

GlobalData’s 2023 UK Life and Pensions Survey found that 18.2% of consumers increased their pension contributions in the 12 months to May 2023, compared to just 3.3% who reduced them. A disproportionate proportion of those who earn in excess of GBP50,000 per year increased their contribution compared to the overall proportion of consumers who earn that much.

Ben Carey-Evans, Senior Insurance Analyst, comments: “It might have been expected that people would have reduced their contributions in a bid to cut household bills during the cost-of-living crisis driven by high inflation. However, for those who can afford it, over the last 12 months, savings rates have been at their most appealing levels in a decade.”

The Bank of England raised the central bank rate for the 13th successive time to 5.0% in June 2023. This translates to more attractive rates for savings accounts and pension funds.

Carey-Evans adds: “Yet this is not all good news for savers, as the central bank rate remains considerably lower than the latest inflation figure of 8.7%. Therefore, even if their pension pots are growing, savers are losing money at current prices. Furthermore, pensions are not simply savings accounts, and some funds will be pushed towards more risky investments by inflation levels.”

According to GlobalData, people who can afford to spare any money have been utilizing the improved rates pension funds have been offering. Although only 16.9% of consumers earn in excess of GBP50,000 per year, 32.4.% of those who increased their contributions in the past 12 months fall into that wage bracket. Similarly, 42.9% of the 3.3% of consumers who reduced their contribution were in the GBP16,000–29,999 per year wage bracket.

Carey-Evans concludes: “As the saving environment continues to improve and inflation is expected to fall later in 2023, pension funds should continue to see increases in contributions from wealthier clients.”

|