• To be financially independent for 25 years in retirement, the average UK household would need to save £743,338.

• Financial freedom for life could cost £1,183,363 for younger generations as a result of inflation

• Expert reveals manageable ways you can begin working towards financial independence

Financial independence is the point at which your savings or other sources of passive income are enough to cover your living expenses without relying on a wage, but how much would it take for the average household to reach a point where they can consider themselves to be financially independent?

New research from Shepherds Friendly has analysed average household spending across the UK, the typical value of household debt, and the amount recommended for a six-month emergency fund to uncover how much you would need to save to achieve 25 years of financial freedom in retirement.

To calculate this, they considered two key factors: the rising cost of goods over 25 years, based on an average annual inflation rate of 2.88% (using historical UK data), and a 5% return on savings or investments. These assumptions help estimate how much money a household would need today to fund 25 years of expenses while only withdrawing what’s needed each year.

The full research can be found here

To live financially independently for 25 years, the average UK household would need to save £743,338. The average UK household spends £31,653 a year - totalling £1,168,765 over 25 years with yearly inflation applied. Add in average household debt of £121,525 and a six-month emergency fund, and the cost of financial freedom rises to £743,338.

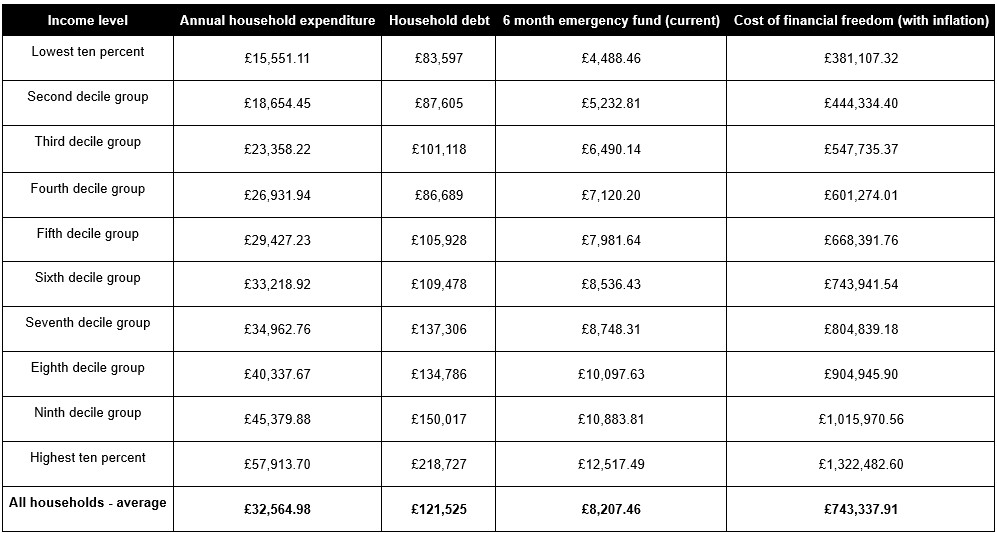

According to household spending by income level, the lowest earning 10% have a current annual expenditure of £15,551 and an average debt of £83,597, meaning they would need approximately £381,107 for 25 years of financial freedom, after adjusting for inflation.

On the other hand, households with higher-than average expenditure and debt will face a steeper target. A household in the top 10% of earners has an annual average expenditure of £57,914 and around £218,727 in debt, meaning they would need as much as £1,322,483 to achieve financial freedom for 25 years, with inflation applied.

Income level Annual household expenditure Household debt 6 month emergency fund (current) Cost of financial freedom (with inflation)

It’s important to acknowledge that these are estimates based on current spending, so individuals will need to make adjustments if their spending habits shift over time, if they plan to retire sooner, or if they outlive their 25-year pot.

Financial freedom for life could cost over £1 million for those wanting to get ahead early in life.

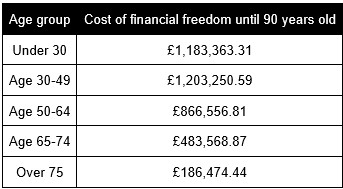

For many, financial independence isn’t just about retiring early - it’s a long-term goal to live free from work for life. The data reveals that age plays a huge role in determining how much you would need to save to be financially free until 90 years old.

For those aged 18-30, financial independence for life means covering expenses for a longer period of time, and they must take into account inflation over a longer period. With this in mind, the average amount needed for financial independence up until the age of 90 increases to £1,183,363, a figure which again takes into account yearly inflation.

The closer you get to retirement age, the more the financial burden eases. Those in their 50s and early 60s could need just under £1 million, while people aged 65–74 require around £500,000. For those already over 74, the cost drops to approximately £180,000.

Derence Lee, Chief Finance Officer at Shepherds Friendly, reveals manageable ways to help reduce debt and build your wealth, helping to pave the path for financially secure future:

1. Plan effectively and set realistic milestones for saving: Have an understanding of your future costs and consider the best places to keep your money. For example, emergency savings are likely best kept in easy-access accounts so you can take funds out quickly if needed. For medium- to long-term goals, like a house deposit or a new car, ISAs offer a better balance of flexibility, as well as growth potential thanks to any interest earned being tax free.

2. Take your debt, starting with high interest debt: A common and effective strategy for becoming debt free is to focus on paying off high-interest debts first, as these cost you more over time. If you’re unsure, you may wish to speak to a financial adviser, as they can help you to find ways to tackle your debt that suit your current situation.

3. Build an emergency fund: Save 3-6 months’ worth of essential expenses to cover unexpected costs like job loss or car repairs - helping you avoid further debt. Start small and gradually build your fund over time as even modest savings can help to prevent you falling back into debt when the unexpected happens.

4. Protect savings from inflation: Leaving savings in a standard account can mean they lose purchasing power over time. A Stocks & Shares ISA, for example, offers a tax-efficient way to diversify your financial portfolio, allowing you to invest in a wide range of assets - such as index funds, bonds, and equities - while protecting your returns from income and capital gains tax. Over the long term, a Stocks and Shares ISA can also help protect your savings from inflation.

5. Cut unnecessary spending: Review subscriptions, switch providers, and renegotiate bills. These small changes can free up funds to put towards your goals. This doesn’t mean giving up everything you enjoy - but small changes can add up.

|