Kate Smith, Head of Pensions at Aegon comments on how salary sacrifice may be used to offset the initial increase in National Insurance: “Salary sacrifice arrangements are a powerful and tax-efficient way of paying pension contributions, as neither the employee nor the employer pay National Insurance contributions on the amount of salary exchanged. And the employee won’t pay income tax on the amount exchanged either. Salary sacrifice arrangements designed to pay pension contributions have become increasingly popular in recent years as many employers use these to help cover the costs of pension contributions.

“The increase in 1.25% NICs from next April increases employer’s payroll costs and will reduce employees’ take-home pay, making salary sacrifice even more attractive to dampen the increased costs.

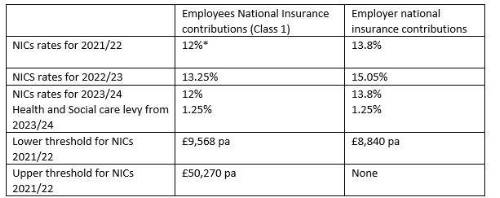

“It should be remembered that the Government’s purpose of increasing NICs is to raise funds to cover health and social care costs using a two step approach. Initially the 1.25% NICs increase will be simply added onto the amount of NICS paid by employers and employees. From April 2023 the 1.25% appears to be ringfenced as the new Health and Social Care Levy, clearly identifiable on employees’ payslips and potentially on employer’s NICs payments. For the first time those over the State Pensions Age with earned income will have to pay the 1.25% Levy.

“One way to offset this increased cost and to maintain current take-home, or increase pension contributions, is to use salary sacrifice arrangements. However, while this may be possible for next year when the extra 1.25% is wrapped up with NICs and is indistinguishable, it may not be possible from April 2023 when it becomes a clearly identifiable levy, possibly with funding ringfenced. If this is the case, it’s likely that it won’t be possible to salary sacrifice away the 1.25% levy. Even if this proves not too be the case, the moral dilemma still remains over whether you should use salary sacrifice to avoid paying the Levy?”

How does salary sacrifice work?

Salary sacrifice is an agreement between an employer and employee to reduce an employee’s cash pay, usually in return for a non-cash benefit. It’s an extremely tax-efficient way of paying or boosting pension contributions, as the amount of salary exchanged is not liable to income tax or National Insurance contributions (both employer and employee), as it technically becomes an employer pension contribution. The effect is that an individual’s taxable income and NI contributions are reduced. Employers don’t pay NI contributions on their pension contributions.

Salary sacrifice isn’t suitable for everyone as it could lead to reduction in some state benefits and could impact mortgage applications. It may also impact other employee benefits such as life cover, although many employers will use a higher "reference" salary for these purposes. Salary sacrifice can’t be used to reduce someone’s earnings below the national minimum wage rates.

National Insurance rates for employees and employers

|