Most with-profits funds generated a positive total asset return in 2024, at an average rate of 5.6%, according to this year’s ‘UK with-profits funds’ report from Barnett Waddingham (BW), a Howden company.

The analysis uses private data from 82 with-profits funds from 21 insurers. It is designed to help UK life insurers determine whether their with-profits asset allocation remains appropriate for them, and whether their asset managers have performed well compared to peers. The 2024 analysis found that 77 of those funds generated positive returns. On average, with-profits funds outperformed BW’s benchmarks for government and corporate bond asset classes, were close to the benchmark for UK equities, and underperformed BW’s benchmarks for overseas equities and property.

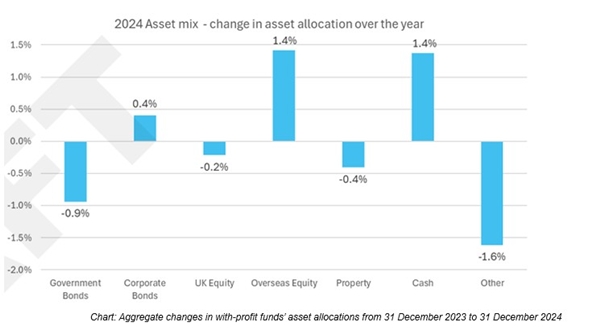

Most with-profits funds take a long-term investment view, so their asset mix remains largely stable. However, in 2024, many fund managers increased their allocation to overseas equities and reduced their allocation to UK equities, part of a long term shift to remove UK equity bias. This allowed them to benefit from the global market rally in the wake of the presidential election and AI-boom. While there continues to be a very strong UK bias in equities for the average fund of all sizes, managers who increased their overseas exposure generated far higher overall fund performance.

Managers also increased their corporate bond allocations and decreased allocations to government bonds in 2024, and upweighted their cash holdings. This differs by fund size; larger funds have a higher equity (including property) backing ratio (49%) compared to smaller funds (35%).

Craig Turnbull, Partner at Barnett Waddingham said: “Most with-profits funds are generating a positive return, and beating the fixed savings rates available on the high street. Managers that actively shifted their asset allocation reaped the rewards of buoyant global equity markets, while assets languishing in government bonds almost universally reported a loss. For insurers, there is an untapped opportunity to generate value from their with-profits funds.The management and governance structures in this space are pretty static; just two funds changed manager in 2024, and more than a quarter of firms have had the same manager in place for eight years or more. While general service reviews are carried out relatively regularly, fee arrangements are rarely renegotiated; more than 40% of firms last renegotiated their fee arrangements over five years ago. It is critical that these conversations happen frequently - ideally every three to five years - as there may be scope for managers to secure material savings and better value for money.”

|