As employers and employees continue to navigate the post-pandemic working world, the debate around the pros and cons of remote work rages on. Some businesses are calling for more in-person time citing a need to boost collaboration and development, while others embrace greater flexibility and make it front and centre of their employee offering. Employees are split too, with some emphasising the time and cost saving potential of working from home and others missing the structure and connection office work can bring.

With the conversation ongoing, new analysis from Standard Life, part of Phoenix Group shows that one potential advantage of flexible working is the opportunity to boost your retirement income by directing saved travel costs into your pension. Employees who work from home even just a couple of days a week could see a significant uplift.

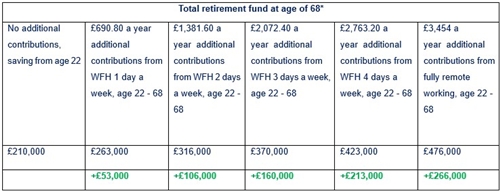

The potential hybrid working pension benefit

Commuters who spend five days a week in the office pay an average of £3,454 per year to get into work by train. However, those who have the opportunity to work from home three days a week would reduce the cost of commuting to £1,381.60 on average – saving £2,072.40 per year.

Standard Life analysis finds that someone who began working full-time, post-pandemic, with a salary of £25,000 a year and paid the minimum monthly auto-enrolment contributions from the age of 22, could have a total retirement fund of £210,000 by the age of 68, allowing for 2% inflation over the period. However, if someone with a hybrid role chose to pass on their £2,072.40 commuter savings over the course of their career could build up as much as in their pension pot £370,000 by the age of 68 – £160,000 more. Those that save on the commute by working from home more frequently could generate an even larger pot, if they passed these costs into their pension:

*assuming 3.50% salary growth per year, and 5% a year investment growth. Commuting costs added as a one-off payment each year. Figures allow for 2% inflation. Annual Management Charge of 0.75% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied.

Based on the average commuter cost in Manchester, if someone worked from home three days a week and put those savings into their pension, they could build up an additional £117,000 in their pension pot by the time they retire. Glasgow commuters could save an extra £109,000 and London commuters could save £236,000.

Mike Ambery, Managing Director for Workplace Pensions at Standard Life said: “Since the pandemic, flexible working options have given workers a number of opportunities, including the ability to save on their commuting costs. While it’s tempting to use any savings to help with the short-term, directing them into your pension could have a really powerful impact over time. Our calculations highlight how working from home for even one day a week could make a huge difference to your eventual pension pot if you were to pass those savings on in extra pension contributions over the course of a career, thanks to the power of compound investment growth.

“With most UK adults currently under-saving for retirement, it’s never been more important for people to consider when and how they can top up their pension to maximise their retirement income. There’s an ongoing discussion around the right balance between home and office working, and the needs of both businesses and individuals differ. However, it’s worth considering how the financial side of different working setups can influence longer-term goals like retirement.”

Catherine Foot, Director of Phoenix Insights, Phoenix Group’s longevity think tank said: “While working from home isn’t for everyone, flexible work can be a game changer in helping workers balance employment alongside caring responsibilities, or to better manage their physical or mental health. Having flexibility over the location and hours worked is particularly important to employees aged 50 and over, playing a key role in helping them think differently about when and how they work, save and retire. This could make a vital difference in ensuring they are able to stay in work for as long as they need or want to, reducing the likelihood of them falling out of the workforce, enabling them to save for their retirement.”

|