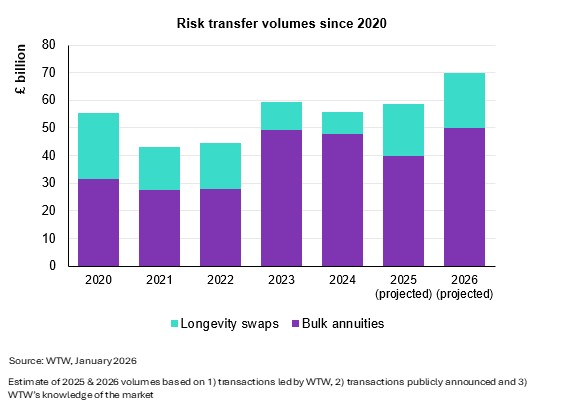

According to WTW’s annual De-risking report, the bulk annuity, longevity swap and alternative risk transfer sectors will continue their upward trajectory, supported by favourable pricing, strong competition and ongoing product innovation.

WTW forecasts that total risk transferred to insurers and reinsurers is likely to reach £70 billion in 2026 – up approximately 15% from the already high volumes seen in 2025.

The bulk annuity market itself is projected to exceed £50 billion, fuelled by both larger transaction sizes and persistently attractive pricing.

Longevity swaps of up to £20 billion are also anticipated. Whilst longevity risk transfer volumes will be driven by large schemes, there is growing interest from schemes of all sizes to support run-on strategies or to lock down a key aspect of future bulk annuity pricing.

“The risk transfer market is entering 2026 with strong momentum,” said Gemma Millington, senior pensions risk transfer director at WTW. “Schemes continue to benefit from improved funding levels and strong insurer appetite, which together create very favourable conditions in which to secure members’ benefits at compelling prices. We expect this window to remain open through 2026, but trustees will need to be prepared and strategic to take full advantage.

“In 2025, the UK risk transfer market passed £0.5 trillion in transactions since the market was founded. This is a significant milestone in the UK defined benefit pensions industry and we are incredibly proud to have led the advice in over 25% of deals by value.”

Competition drives attractive bulk annuity pricing

WTW’s report notes that the UK market’s competitiveness remains “exceptionally strong”. While additional scrutiny from the Prudential Regulation Authority’s assessment of funded reinsurance models may create pricing headwinds for some insurers, WTW anticipates only limited impact on overall market dynamics.

“Insurers have continued to evolve their asset-sourcing capabilities, in some cases through new global asset manager relationships, which is helping to maintain pricing strength despite potential regulatory shifts,” Millington added.

New forms of risk transfer on the horizon

Beyond the headline bulk annuity growth, WTW predicts a notable rise in alternative risk transfer solutions, including an expansion of the UK’s superfund market. Two new entrants are forecast in 2026, along with a doubling in the number of completed superfund transactions to date.

The firm also anticipates at least one entirely new risk transfer solution emerging in the coming year, continuing the trend of innovation prompted by evolving client needs.

Acquisitions unlikely to disrupt day-to-day insurer operations

Several high-profile acquisitions of UK insurers by overseas investors are expected to be completed in the first half of 2026. WTW believes these ownership changes are unlikely to materially affect the market, though it encourages trustees to undertake thorough financial due diligence where relevant and be alive to any short term operational or cultural disruption.

Cyber risk rises to the top of trustees’ agendas

With the increased use of digital platforms, trustees are placing heightened emphasis on cyber resilience when selecting their preferred insurer. The Government’s 2025 Cyber Security Breaches Survey revealed that over 40% of UK businesses experienced a cyber breach or attack in the past year, highlighting the importance of robust safeguards.

“Cyber security has become an important measure of member protection, not just an operational concern,” said Millington. “Trustees are rightly demanding evidence of strong controls and clear response frameworks. Insurers who can demonstrate excellence in this area will stand out in 2026.”

Demand for a smooth transition to buyout increases

WTW expects insurers to expand services that help schemes progress efficiently from buy-in to buyout, including taking on more data cleansing responsibilities and offering solutions to accelerate GMP equalisation.

With insurer and scheme administrator resources stretched, and queues for buyout transitions growing, streamlined insurer propositions will be a decisive factor for many trustees.

A year of opportunity—if schemes act decisively

“As we look ahead, 2026 offers trustees a powerful combination of market depth, competitive pricing and expanded choice,” Millington concluded. “But the scale of activity means that timing and readiness are more important than ever. Schemes that plan early and engage collaboratively with the market will be best placed to secure exceptional outcomes for their members.”

|