Aon Hewitt’s report reflects the medical trend expectations of employer-sponsored medical plans in 90 countries based on reported data from Aon professionals, clients and carriers represented in the portfolio of Aon medical plan business in each country.

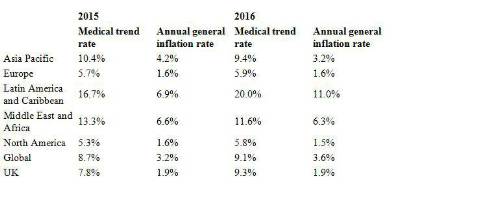

Aon’s figures show that projected trend rates are expected to vary significantly by region. Both Latin America and the Middle East are expected to see double-digit average medical trend rates in 2016, while Europe and North America will experience trend rates just below 6 percent. Average trend rates for all regions are expected to exceed average regional inflation levels by at least 4 percentage points.

Carl Redondo, leader of Aon's Global Benefits practice in the UK, said: “The UK is one of the worst performing markets with higher medical inflation than the European and Global averages. The pressure on the UK’s National Health Service is driving significant growth in the private healthcare sector. In particular the cost of employer sponsored medical plans continues to grow rapidly and is outstripping the medical inflation seen in other European economies.”

Wil Gaitan, senior vice president and global consulting actuary at Aon Hewitt, said: “We expect medical costs to continue to escalate around the world due to global population aging, overall declining health, poor lifestyle habits particularly in emerging countries, continued cost shifting from social programmes and an increase in utilisation of employer-sponsored health plans.

Regardless of the underlying medical insurance system, employers around the world are continuing to experience added organisational cost and lost workforce productivity as a result of these factors.”

Average medical trend rates by region

Global factors impacting medical trend rates

Aon Hewitt’s report found that cardiovascular issues, cancer and gastrointestinal issues were the most prevalent health conditions driving health care claims around the world. Prevailing issues in Europe are cardiovascular, cancer and diabetes. The global risk factors expected to drive future claims and to contribute to the adverse experience driving high medical cost increases, were primarily non-communicable diseases, such as high blood pressure, obesity and high cholesterol, followed by physical inactivity. In Europe, the top reported conditions are high blood pressure, smoking and poor stress management.

Carl Redondo added: "The trends in the UK and Europe mirror those in other parts of the developed world, with smoking, dietary habits and exercise seen as the most important areas on which individuals should focus to improve their health.”

The Aon study highlights the need for employers to analyse the root causes of their medical claims and then take actions to help improve their situations in the future.

Carl Redondo continued: “In-depth analytics can inform an employer of its own particular risks versus the market in general. Trends in claim patterns can quickly allow employers to target the most effective mitigating actions.”

Infographic: 2016 Global Medical Cost increases expected to be 2.5 times higher than inflation

|