Car insurance premiums for younger drivers have seen the greatest changes to their average premiums, with premiums for under 25s dropping by 16% on average year-on-year. Drivers aged 17 experienced the greatest price fall compared to other age groups, benefiting from a significant 25% annual price decrease, reducing their average premiums by £636 from £2,568 to £1,932. Drivers aged 18 saw the next biggest reduction in annual prices of 18%, taking their average premiums to £2,262.

While all age groups saw double digit falls, drivers aged 48 saw the most marginal decrease to their car insurance prices with a fall of 10% (£73) and an average annual premium of £653.

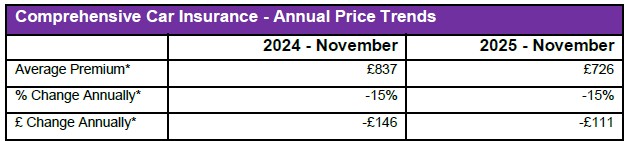

Average car insurance premiums have fallen by £269 (27%) since prices peaked at £995 in December 2023, with prices having decreased for eight consecutive quarters, according to the longest established and most comprehensive car insurance price index in the UK. However, the latest price fall of 1% (£9) during September to November 2025 was the smallest quarterly drop since the current downward trend began in early 2024, indicating a continued deceleration in the pace of price reductions.

Source: WTW / Confused.com Car Insurance Price Index. *Average values rounded to the nearest whole number.

Tim Rourke, UK Head of P&C Pricing, Product, Claims and Underwriting at WTW, said: “Motorists have benefitted from lower insurance premiums driven by a continued decline in personal injury claims through 2025. Most likely due to the whiplash reforms, bodily injury claims have now fallen from 16% of insurers’ spend in 2021 to 9% in 20252.

“While UK motor insurers can expect to break even in 2025, rising claims inflation and higher repair costs linked to increasingly complex vehicle technology may lead to losses in 2026, putting pressure on insurers to reverse the recent downward trend in prices.”

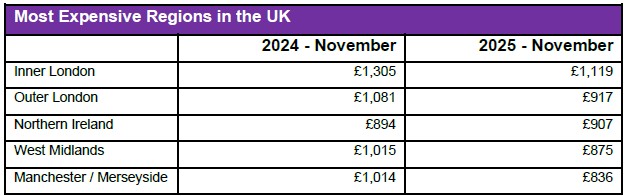

Northern Ireland was the only region to experience an annual rise in prices, where premiums increased by 1% from £894 to £907. This reflects a significant increase in its ranking compared to previous years, largely due to smaller price drops compared to other regions. Northern Ireland is now listed as the third most expensive region in the UK for car insurance, only narrowly behind Outer London in second place.

Drivers in Manchester / Merseyside saw the largest percentage decrease in the cost of comprehensive car insurance, with an annual dip of 18% (£178), reducing their premiums from £1,014 to £836. Drivers in the North West benefited from the next biggest percentage drop at just under 16% (£123), with their premiums decreasing from £790 to £667 during the same period.

Of the regions to experience a reduction, the smallest was seen in the Scottish Highlands and Islands, where drivers saw a more modest annual fall of 8% (£51), with average premiums now at £574 compared to £625 in November 2024. South West England remains the cheapest region for car insurance, where average premiums now cost £500, with Central and North Wales following close behind at £509.

Source: WTW / Confused.com Car Insurance Price Index. *Average values rounded to nearest whole number.

More locally focused data shows motorists in the Manchester / Merseyside postcode areas of Liverpool and Bolton benefited from the biggest annual falls in car insurance premiums, where prices dropped by 20% and 18% respectively. Drivers in Liverpool saw premiums decrease from £998 to £799, while average prices in Bolton fell from £1,049 to £858. West Central London, still the most expensive postcode in the country, saw an annual fall of 12% (£193), with average premiums now at £1,444 compared to £1,637 in November 2024.

Llandrindod Wells in Wales continues to be the cheapest town in the UK with prices on average now costing £476, where prices fell by 7% compared to 12 months ago. Drivers in the South West towns of Torquay (£482), Truro (£484), Exeter (£486) and Dorchester (£487) also continue to enjoy average premiums less than £500.

Steve Dukes, CEO at Confused.com, comments: “This recent drop in car insurance prices signals more than 12 months of decreases. While this creates opportunities for customers to save, motorists can see cost increases on the way in the form of vehicle excise duty, fuel prices and more. Customers continue to wrestle with broader financial pressures and so continue to look for ways to refresh their financial commitments, review the cover they have and save where they can.”

|