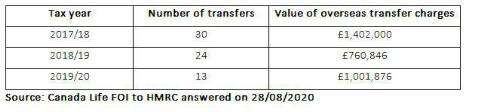

The 25% transfer charge, introduced in the Budget of March 2017, was levied on 13 transfers in the tax year 2019/20 and raised just over £1m in tax. This compares to the previous tax year where 24 transfers attracted charges totalling £760,846. Although the number of transfers has steadily fallen since the charge was introduced, the value of overseas charges has actually risen compared to the previous tax year due to the size of the transfers made.

Broadly speaking the transfer charge applies unless the member is resident in the same country in which the QROPS is established, or the member is resident in a country within the European Economic Area (EEA) and the QROPS is established in a country within the EEA.

Andrew Tully, technical director at Canada Life, commented: “The charges levied on certain pension transfers overseas has effectively done the job in limiting the appetite for moving pensions outside the UK to destinations other than the EEA. We’ve witnessed a steady fall in QROPS transfer activity since the peak of 2014/15 and this has only accelerated following pension freedoms and the introduction of the transfer charge.

“Despite the number of pension transfers attracting a charge being very small, and therefore the amount of tax raised as a result very low, Treasury will be pleased another tax loophole has effectively been closed and further tax leakage prevented.”

QROPS transfer charge explained

In the March 2017 Budget, then Chancellor Philip Hammond introduced a 25% tax charge for qualifying pension transfers. It was hoped the introduction of a charge would discourage transfers from UK schemes where the person is seeking to reduce their tax liability by moving their pension wealth to a new jurisdiction. Government figures published at the time suggested the measure would raise £65m for the Exchequer in 2017/18, £60m in 2018/19 and £60m in 2019/202. The tax charge is typically applied where the QROP resides outside the EEA3.

According to data from HMRC the number of pension transfers to QROPS peaked in 2014/15 with 20,100 transfers valued at £1.76bn. The number of transfers has reduced considerably over following tax years, and for 2019/20, HMRC recorded 4,400 transfers worth £550m4.

|