Adopting the new CMI model may lead to a small reduction in surpluses, but Trustees and Employers will need to tailor the model to reflect the impact of post-pandemic stresses, which vary depending on the age and socioeconomic profile of a scheme’s membership.

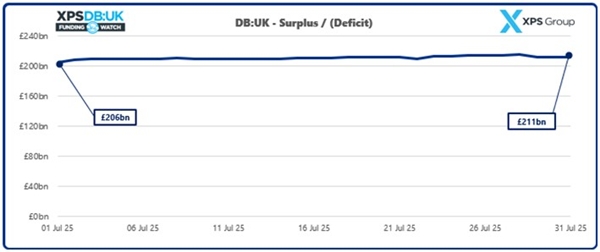

Since July 2024, UK pension schemes’ funding positions have improved relative to long-term funding targets, according to new analysis from XPS Group. With assets totalling £1,163bn and liabilities of £952bn, the aggregate funding level of UK pension schemes (on a long-term funding target basis) remains strong at 122% of the long-term value of liabilities. This marks a 24% increase in surplus over the past year, as of 31 July 2025. However incorporating the latest mortality data in the new projections model may may increase liabilities by approximately 1%, potentially reducing funding levels.

At the end of June 2025, the Continuous Mortality Investigation (“CMI”) released its latest model projecting life expectancy in the UK, incorporating death data in England and Wales up to the end of 2024. The new model bucks the trend of recent CMI models, which have projected declining life expectancy. However, Trustees and Employers should tailor the model to reflect how their scheme’s membership may have been impacted by elevated mortality rates since the pandemic, and what any ongoing recovery in mortality rates may look like for their age, sex and socioeconomic profile.

It is also important to note that insurers, who will largely use the model to benchmark their own assumptions, may have already factored in these improvements into their mortality assumptions.

2024 recorded the lowest all-age mortality rates on record in England and Wales, although mortality rates remain lower than those projected before the COVID-19 pandemic. This trend has continued into 2025, with all-age mortality rates remaining comparable to 2024. However, this trend masks significant variation in mortality improvements across different ages. Whilst pensioner-age mortality has fallen sharply, younger working-age adults continue to experience higher mortality than the 2014-2023 average.

One of the most significant changes to the model is that it now accounts for differing trends in mortality, explicitly including increased mortality rates experienced during the COVID-19 pandemic. This reflects the industry’s adaptation to post-pandemic mortality patterns. However, Trustees and Employers should remain vigilant when it comes to tailoring these assumptions to reflect the age and socioeconomic profile of their scheme’s membership.

Hannah Traylen, Senior Consultant at XPS Group said: “While we are seeing some positive headline improvements in mortality rates, it’s important to note that these improvements are primarily driven by reductions in mortality at older ages. Trustees and Employers should remain cautious in applying these trends to their funding assumptions, as younger working-age adults continue to experience higher mortality rates than pre-pandemic levels. Schemes must carefully tailor their mortality assumptions to reflect the unique demographic profile of their membership, taking into account factors like age, socioeconomic status, and the ongoing impacts of the pandemic on different groups before they assess the level of their own surplus and make strategic decisions.”

|