Pension Engagement Season ongoing, new Standard Life analysis1 finds that the UK’s youngest pension savers could set themselves up with an extra £26k in retirement for roughly the cost of a monthly Netflix subscription. While Gen Z won’t necessarily be focussing their attention on retirement funds now, those who are able to save even just a bit more into their pension could find themselves better off in future – without having to break the bank.

A small cost today could make a huge difference in future

Standard Life’s analysis highlights how modest increases in pension contributions can significantly enhance retirement outcomes, thanks to the power of compound investment growth.

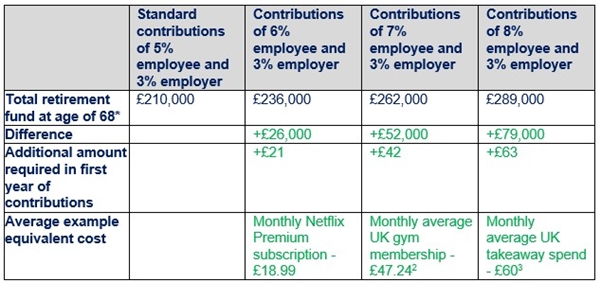

For example, someone who starts working at age 22 on a salary of £25,000 and pays the minimum auto-enrolment contributions (5% employee, 3% employer) could build a pension pot of around £210,000 by age 68, adjusted for inflation. However, increasing monthly contributions by just 1% - roughly the price of a Netflix Premium subscription (£18.99) - could grow this to £236,000, an uplift of £26,000 in today’s prices.

Those who can set aside slightly more each month, such as the equivalent of a monthly gym membership, could build up an even bigger pension pot:

*assuming 3.50% salary growth per year, and 5% a year investment growth. Figures account for 2% inflation. Annual Management Charge of 0.75% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied.

Mike Ambery, Retirement Savings Director at Standard Life, said: “While retirement may feel a long way off for younger savers, small and consistent contributions can have a powerful impact over time. You don’t need to give up all the things you enjoy – it’s about finding the balance between living for today and planning for tomorrow that works best for you. Redirecting a modest amount each month – even something as relatively small as the cost of a streaming subscription – could add tens of thousands to your pension by the time you retire. And for those able to contribute a little more, such as reallocating part of their gym or takeaway budget, the long-term benefits could be even greater. It’s very important to treat yourself now and then, but Pension Engagement Season is a timely opportunity to reflect in your longer-term financial priorities and consider whether small adjustments could help you build a more secure financial future.”

Mike Ambery’s tips for younger pension savers

See if your employer will chip in more “Some employers will match extra contributions — so if you increase yours, they might increase theirs too. That’s essentially free money for your future self. It’s worth checking if this applies to you and making the most of it.”

Understand ‘salary sacrifice’ “If your employer offers ‘salary sacrifice’, you can swap part of your salary for pension contributions. It could lower your National Insurance payments – reducing your tax liability while giving your retirement savings a boost. It’s worth checking with your employer.”

Got a pay rise? Remember your pension “When your salary goes up, consider putting a bit of that increase into your pension. You won’t miss what you never had, and it’s a great way to grow your savings without feeling an impact on your monthly budget.”

Tax relief means more for your money “Pension contributions usually come with tax relief - so a £100 contribution might only cost you £80 if you’re a basic-rate taxpayer. Higher earners could get even more back. It’s one of the few times you might enjoy hearing about tax, so take advantage!”

Lump sums can go a long way “If you get a bonus, tax rebate, or even some birthday cash you don’t need right away, Putting a chunk of it into your pension could give your future savings a significant boost. And thanks to compound investment growth, it could be worth much more by the time you retire.”

Check in once a year “Your life and finances change, so it’s smart to review your pension contributions at least once a year. Online pension calculators can help you see if you’re on track, and even small tweaks can make a big difference over time.”

Keep the balance “Saving for the future is important, but so is enjoying life now. You don’t need to give up every treat - just make sure your pension contributions fit alongside your other priorities, like rent, bills, and building up an emergency fund. If you’ve got a few months of expenses saved, you might be in a great spot to start thinking longer-term.”

|