The ABI’s latest data tells us that sales are off to a hot start in 2023, too, surging 22% during the first three months of the year.

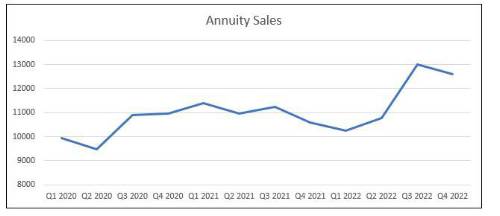

Damon Hopkins, Head of DC Workplace Savings at leading independent consultancy Broadstone, commented: “The return of the annuity was the retirement story of 2022. Sales increased as pension savers took advantage of the spike in interest rates and gilts to secure fixed retirement income at their highest level in years.

“The acceleration in Q3 and Q4 chimes with ABI data that suggests annuity sales are now starting to see significant increases as savers reaching retirement are attracted to the idea of securing income at a lower cost, given the rise of annuity rates as interest rates spiked over that period.

“As it stands currently, pension savers with a £100,000 pot looking to buy an annuity are likely to generate thousands of pounds more annual income compared to a couple of years ago which is clearly driving the higher demand for annuities.

“When it comes to securing a good standard of living in retirement, a lot of scrutiny is focused on contribution rates and investment returns, but decisions made at the point of decumulation can be vital in maximising savers’ pots and may be worth significant sums.

“When it comes to annuities, simple steps like shopping around and disclosing medical conditions can be key to making hard-earned savings work harder and getting a better rate.”

|