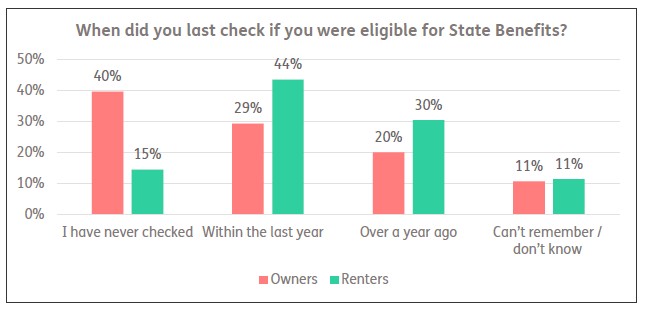

Four in 10 (40%) pensioner homeowners have never checked if they are entitled to State Benefits beyond their State Pension, research by retirement specialist Just Group finds.

The survey of 2,000 people aged over 66 found that renters were far more likely to have assessed their benefit eligibility with only 15% saying that they had never checked to see if they were entitled to additional State Benefits.

Take up of State Benefits has come under greater scrutiny recently following the restriction of the Winter Fuel Payment to people claiming Pension Credit. This change triggered campaigns to increase the number of pensioners receiving the crucial benefit, especially those who are entitled to it but not yet claiming it.

A greater proportion of renters reported checking their eligibility for State Benefits within the last year (44%), compared to 29% of homeowners. Renters also checked their eligibility more often in the past; 30% of renters said they had done so more than a year ago, compared to 20% of homeowners.

This survey builds on Just Group’s 15th annual State Benefits insight report2, published in January 2025, which revealed that 79% of pensioner homeowners were failing to claim any of the benefits they were eligible to – missing out on an average of £1,807 in additional annual income. The insight report based on in-depth fact-finding interviews with clients seeking advice on equity release in 2024, also identified a further 9% of pensioner homeowners who were receiving some benefits but were under-claiming - missing out on an average of £2,915 additional income.

Stephen Lowe, group communications director at Just Group, said: “This research, published hot on the heels of ‘Awful April’ which saw many household bills rise for pensioners across the country, underlines the importance of people checking to see if they are entitled to additional State Benefits. It is concerning that pensioner homeowners do not check their eligibility for valuable financial support, suggesting a common assumption that home ownership disqualifies them from benefits like Pension Credit. Our own work with pensioner homeowners confirms that many are missing out on thousands of pounds every year in unclaimed benefits. We encourage all pensioners – whether homeowners or not – not to assume they are ineligible for support, and instead to make use of the many free resources available to help identify benefit entitlements and guide them through the claims process.”

|