By Christopher Critchlow, Consultant Actuary, OAC Actuaries and Consultants

Welcome to the first of three articles summarising the key themes under Solvency II. Given the breadth and depth of Solvency II, this is just a taster of the detail underpinning these areas: you’ll have to get into the detail to have a sound knowledge of the new requirements. The final rules also have yet to be finalised – whilst this shouldn't affect the principles, they may affect specific aspects of the new rules.

The main topics you need to consider are –

- Component parts

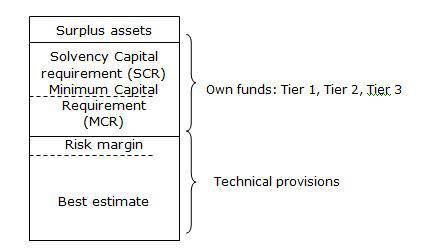

The main principle of Solvency II is that a firm must hold sufficient assets to cover its technical provisions and regulatory capital requirements. The capital requirements should reflect the specific risks to which the insurer is exposed allowing for the management actions the firm is prepared to take under adverse events. The capital requirements are calibrated to a 99.5% level of confidence over a one-year time horizon.

- Timescale for implementation

The application of Solvency II will be effective from 1 January 2016.

- Proportionality

Solvency II allows a proportionate approach to be used as long as it does not affect the decision-making or judgement of the intended user.

- Own funds

Own funds consist of basic own funds and ancillary own funds. Basic own funds are essentially the value of approved asset types (including paid up share capital) less technical provisions; ancillary own funds require prior supervisory approval and are items of capital other than basic own-funds which can be called up to absorb losses. Own funds may be split into one of three tiers, except that there are no Tier 1 ancillary own funds. Limits apply on the specific amounts that firms may hold of Tier 2 and Tier 3 capital.

- Best estimate approach

The arrival of Solvency II marks an end to the days of prudence. Liabilities should be calculated on a best estimate approach such that there is a 50/50 likelihood of being above or below the actual. The methodology should be proportionate (see above) to the nature, scale and complexity of the business. All relevant policy cashflows should be valued (except investment returns). More detail on the components of the best estimate are given below.

- Contract segmentation

Firms need to split contracts of insurance into one of 12 non-life or six life lines of business. Principle of substance over form applies. Where a contract has life and non-life parts, it should be unbundled into its relevant parts.

- Contract boundaries

A term used to describe the period over which premium and liability cashflows should be assessed. This is relevant where contracts include options for the policyholder to extend (cover or term), or to effect a new contract. Generally all obligations belong to the contract unless they meet predefined conditions.

- Discount rate

This is not the expected return on actual assets held, but is instead the assumed “risk-free” rate of return according to outstanding term – effectively a yield curve. For each territory this is based on interest rate swap rates for the relevant currency adjusted for credit risk.

- Expenses and Tax

Liability cash flows should make appropriate allowance for expenses and tax. Expenses should include administrative expenses, investment fees, claims management expenses, acquisition costs (if relevant) and overhead expenses. Tax should be allowed in cases where it affects the amount charged to policyholders or is required to settle an insurance obligation.

- New business

Liability cash flows on contracts of insurance should make allowance for expected future overhead expenses. The share of overheads should be assessed on the basis that the insurer continues to write further new business. As such, allowance for new business volumes is needed.

- Inflation

Each insurer has to form its own view on the impact inflation might have in the valuation of both its assets and liabilities. No explicit inflationary stress test applies except under the expense stress. This may be a material point to consider in a firm’s Own Risk and Solvency Assessment (ORSA) if it has inflation linked contracts.

- Approach for with profits

Market consistency is key. This should generally be asset shares plus cost of guarantees where guarantees are assessed using some stochastic methodology.

- Policyholder behaviour and management actions

Policyholder behaviour should be allowed for on a realistic basis based on current and credible information. Assumptions should be dynamically linked with economic circumstances. Management actions may be allowed for, such as changing bonus rates, changes to charges applied to unit-linked business and so on. However, management actions must be consistent with other actions assumed in the calculation of the best estimate and under stressed conditions.

Solvency II is a radical departure from the existing approach to the regulatory valuation of assets and liabilities but one that should provide more relevant information and help embed better risk management within insurance companies. The discussion above sets the scene of some of the main principles on which Solvency II is based; in the next two articles we explore further aspects of Solvency II such as the nature of the stress tests for specific risks.

|