You voted in your thousands, and Actuarial Post is delighted to announce the winners of the inaugural Actuarial Post Awards. We are proud to bring you the winners across all major actuarial disciplines and a huge congratulations goes to all winners from the AP team. You voted in your thousands, and Actuarial Post is delighted to announce the winners of the inaugural Actuarial Post Awards. We are proud to bring you the winners across all major actuarial disciplines and a huge congratulations goes to all winners from the AP team.

Hilary Salt- Actuary of the Year

Hilary Salt FIA, FPMI is a Founder of First Actuarial LLP. She runs the Manchester office which was formed in 2002, incorporating her already successful consultancy business. Within the organisation she is responsible for all professional issues as well as her 'day job' working with clients. Hilary's client work covers traditional actuarial consultancy including acting as a scheme actuary advising trustees and employers on their final salary schemes in the current, often difficult, pensions's climate. Hilary has two sons and a season ticket to Old Trafford.

What was your initial reaction on winning this award, nominated and voted for by your actuarial peers? "I was delighted to be nominated for this award and absolutely thrilled at the news that I had won. I am conscious that I often say things that do not endear me to my fellow actuaries so my aim in the vote was to ensure I was not embarrassed!"

What would you say to those aspiring to become Actuary of the Year in the future? "Ironically in the current situation, I am conscious that a lot of things I say do make me unpopular! I have two particular moans at the moment. First I have massive concerns that the approach adopted by the Pensions Regulator is a significant factor in forcing schemes to close. This was not the intention in setting up the regulatory system and we as a profession should be standing up to defend schemes against unnecessary pressure. Second I cannot see any practical advantage in my professional body insisting that an actuary cannot advise both the trustees and sponsoring employer of a scheme. This change will not help scheme members but will increase fees and alienate members, trustees and employers even further from the mutual schemes they set up to provide – yes that phrase again – dignity in retirement. Despite saying these things you can’t say, I still won this award. So I guess my advice would be don’t be afraid to speak out if you think there are wrongs which need to be righted!"

Read more of Hilary's interview here

Pensions Actuary of the Year- Ray Pygott Pensions Actuary of the Year- Ray Pygott

Ray Pygott graduated in 1987 with a BSc mathematics. He joined Aon Consulting (formerly Godwins) in 1987 and qualified as an actuary and was primarily involved in providing advice to pension Trustees. In 1998 he joined KPMG and worked in London involved in corporate transactions, merger and acquisitions and corporate pension consulting. Later, he moved to Reading to set up a pensions team in the South of England. This team grew from an original team of 5 to close to 70 people. He was promoted to partner in 2001.

What was your intial reaction on winning this award, nominated and voted for by your actuarial peers? "My reaction when I learnt I was being nominated was a mixture of surprise and gratitude that members of my team thought I deserved to be put forward. It is pleasing to know that the efforts you make recognised by colleagues, peers as well as clients."

Read more of Ray's interview here

Investment Actuary of the Year- Euan Munro Investment Actuary of the Year- Euan Munro

Euan Munro graduated with a 1st Class honours degree in Physics and Electronics from Edinburgh University in 1991. He is a Fellow of Facualty and Institute of Actuaries. Euan is responsible for the investment management process in the Fixed Income and Multi- Asset Investing teams within Standard Life Investments, ensuring a high level of collaboration to deliver high performance fixed interest and multi- asset products.

What was your initial reaction on winning this award, nominated and voted for by your actuarial peers? "Surprise, i had been very pleased to even be nominated, but to actually win is very flattering."

Read more of Euan's interview here

General Insurance Actuary of the Year- Rob Murray General Insurance Actuary of the Year- Rob Murray

Rob joined LCP in 1997 and is a Partner in the Insurance Consulting practice. Rob advises a range of insurance and reinsurance clients writing commercial and personal lines business on matters including Solvency II implementation, reserving and management information. Rob has developed several new techniques for claims reserving which are used to assist LCP's clients with business planning, forecasting and the development of early warning systems. Rob is an Associate of the Chartered Insurance Institute, Past President of the Insurance Institute of Harrow & Ealing.

What was your initial reaction on winning this award, nominated and voted for by your actuarial peers? "I was absolutely delighted just to be nominated for the award. To then win was amazing and i can only thank those who took the time to vote for me."

Read more of Rob's interview here

Life Actuary of the Year- Joseph Lu Life Actuary of the Year- Joseph Lu

Joseph Lu heads a multidisciplinary team of actuaries, staticians, scientists and programmers to manage the risk of people living longer than expected, commonly called longevity risk, at one of the leading annuity providers- Legal & General. His team is responsible for future longevity projection for the pricing and capital requirements for Legal & general's longevity related business with an asset of nearly £30bn. His work covers insurance products such as Individual Annuities, Pensions Buyout and Longevity Swap.

What was your initial reaction on winning this award, nominated and voted for by your actuarial peers? "When approached for my bio for the nomination, I thought I had been mistaken for someone else. I eventually provided the requested information, thinking that my chances of being short-listed, let alone voted, for the award are slim. So, you have overwhelmed me by awarding me 'Life Actuary of the Year' through a poll. This has encouraged me to work harder for the success of insurance risk management."

Read more of Joseph's interview here

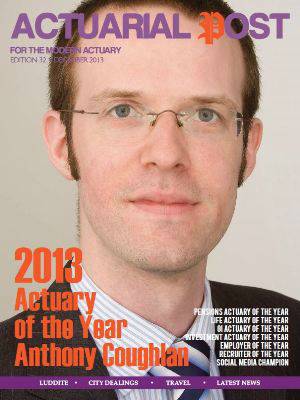

To see the winners of the remaining categories please click the cover of the magazine below.

|