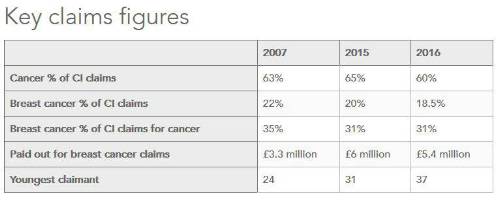

While cancer as a whole made up 60% of all critical illness claims Aegon received in 2016, breast cancer on its own accounted for 31% of these cancer claims – the biggest single cause of Aegon’s critical illness claims that year.

Nearly one in five (18.5%) of Aegon’s critical illness claims in 2016 were for breast cancer.

Almost one third (31%) of Aegon’s critical illness cancer claims in 2016 were for breast cancer.

Aegon has paid £54.6 million to nearly 700 women diagnosed with breast cancer in the last 10 years.

Simon Jacobs, Head of Underwriting and Claims Strategy at Aegon UK said: “Back in 2013 we reported that breast cancer was our biggest single cause of critical illness claims in 2012, this remains the case.

“In the last 10 years Aegon has provided financial support to around 700 women diagnosed with breast cancer, paying £54.6 million in critical illness claims to help them through their diagnosis and treatment. Early detection and better treatment means that survival rates after a diagnosis of breast cancer are improving. This is clearly reflected by the consistent number of claims for breast cancer and also creates a stronger case around the importance of critical illness cover.”

Jacobs continued: “Treatment of breast cancer often involves surgery, chemotherapy, hormone therapy or all three. It’s a difficult time for sufferers and their families and with this in mind we make the claims process as simple and quick as possible.”

“Our tele-claims process gives customers a dedicated claims assessor who will complete the claim form for them over the phone and progress the claim. We usually pay the claim within a few weeks depending on the medical information we need from doctors and how easy that is to get hold of. We’re continually looking for ways to reduce this further.”

Critical illness claims for breast cancer in 2016

Aegon paid out almost £5.4 million in breast cancer critical illness claims in 2016, with an average pay out of £70,981. The average age at claim was 49 years old, with the youngest being only 37 years old.

Breast cancer also accounted for 3.6% of life claims paid in 2016.

To find out more, please read Aegon’s factsheet Helping you understand breast cancer

|