Ben Carey-Evans, Senior Insurance Analyst, GlobalData, comments: “Insurers that establish themselves as leaders in these themes will see improved performance, better products, and enhanced customer service. AI is undoubtedly the leading technology trend in the insurance industry at present. The emergence of agentic AI throughout 2025 has only increased the buzz around the technology and its capabilities. Its impact can be felt throughout the value chain, and agentic AI’s ability to react to live information and make human-like decisions will accelerate the impact AI has on insurance in 2026 and beyond.”

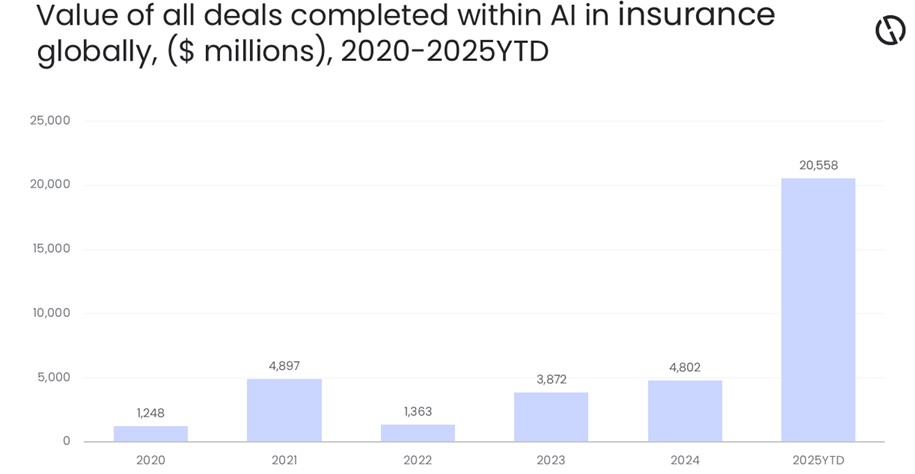

The total value of M&A deals completed within AI in insurance skyrocketed in 2025, registering growth of 328% in terms of value and 125% in terms of volume. Driven in part by the rise of generative AI—especially agentic AI—this trend was also reflected in GlobalData’s other signals databases.

GlobalData’s Jobs and Company Filings databases show strong growth within AI in insurance, which indicates it is an area of focus for insurers. One example was Munich Re’s July 2025 acquisition of Next Insurance, a technology-first commercial property and casualty insurer with a focus on AI and digitalization.

Cyber and climate change/natural catastrophes are also key themes. Cyber insurance is continuing to see rapid growth, and this is forecast that to continue through 2030. GlobalData estimates the global cyber insurance market to be worth $22.2 billion in 2025 and $35.4 billion by 2030.

Climate change, the rise of severe weather events around the world, and natural catastrophe insurance are major issues for insurers, and their impact will only continue to increase in the coming years.

Carey-Evans concludes: “Natural fire and hazard insurance is a major insurance product globally, with premiums and claims seeing sharp annual increases, which are forecast to continue. The frequency of severe weather events is a huge threat to the industry and large areas of the world are becoming uninsurable, which is a major problem for consumers.”

|