The unprecedented nature of this event is expected to send ripple effects across the global aviation insurance market, significantly impacting insurers and reinsurers in India and globally, says GlobalData, a leading data and analytics company.

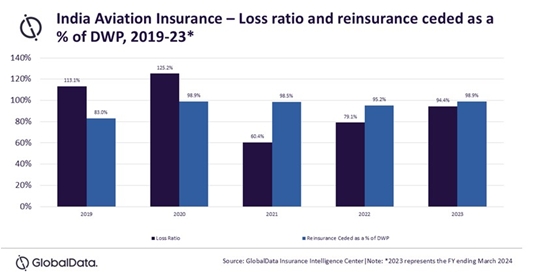

Swarup Kumar Sahoo, Senior Insurance Analyst at GlobalData, comments: “The domestic aviation insurance direct written premium (DWP) stood at $127.8 million in 2023 and claims from this single event could potentially exceed the entire domestic annual premium for the aviation market in India. As domestic insurers have been ceding more than 95% of their aviation insurance DWP to global reinsurers, the financial burden will predominantly fall on international reinsurers, leading to the hardening of the aviation reinsurance and insurance market.”

According to GlobalData’s Insurance Database, although New India Assurance and Tata AIG are the major insurers covering the risk, the impact of this incident on the domestic market is limited as both the insurers generated only 1.1% and 1% of their total insurance premium from aviation and ceded most of it to global reinsurers. The Indian reinsurer GIC Re is exposed to around 5% of the risks associated with the incident due to the mandatory ceding requirement.

Historically, Indian aviation insurance has been loss-making due to a rise in the number of air accidents. Prior air accidents, such as accidents damaging the aircraft parts of Jet Airways, and SpiceJet, and the crash of Su-30 fighter jet have made aviation insurance in India loss-making during 2016-20. This incident will further deteriorate the loss-making Indian aviation insurance market.

Sahoo adds: “The crash is anticipated to cost the insurance industry more than $200 million, including the aircraft, which is valued between $75 million and $80 million, and the liability exposure under the Montreal Convention and domestic legislation. This will harden the 2026 reinsurance renewal as reinsurers are expected to reassess agreement structures.”

Furthermore, the government is considering grounding the Boeing Dreamliner 787-8 fleet, which is expected to increase the associated business interruption claims. This will directly impact the profitability of insurers underwriting such risks.

Sahoo concludes: "Reinsurers are expected to reassess risks associated with wide-body aircraft, recalibrate pricing models, and impose stricter terms. This will reinforce market discipline, accelerate the withdrawal of marginal capacity, and reshape aviation reinsurance arrangement negotiations for the 2026 renewal cycle.”

|