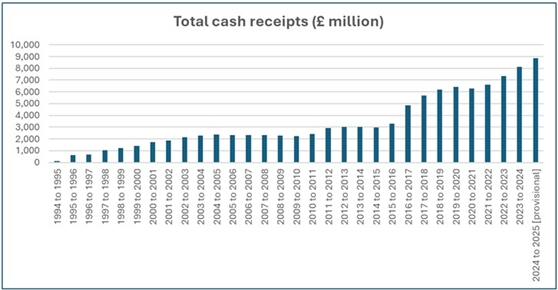

Over the last five years, IPT receipts have risen by £2.58 billion (40%) from £6.31 billion in 2020-21 financial year, to the latest financial year, with the increase from a decade ago even more stark – an uptick of £5.59 billion (170%) to the latest figures.

It follows the latest monthly HRMC update which found that IPT receipts recorded a total of £2.17 billion through the first quarter of 2025/26, an increase of £55 million (2.6%) compared to the same period in 2024/25 (£2.12 billion).

Ewen Tweedie, Actuarial Director at Broadstone, commented: “IPT appears to be the gift that keeps on giving for the Treasury with today’s figures revealing that HMRC collected £8.88 billion in the last financial year – £737 million more than the year before, £2.58 billion more than five years ago, and almost triple the level seen a decade ago. A significant driver of this growth is rising demand for health insurance products, including private medical insurance and cash plans.

“Poor access to NHS services is prompting more individuals to seek private cover while employers are increasingly investing in broader health insurance coverage to protect the productivity of their workforce, often footing more expensive claims as delayed treatment and diagnosis exacerbate employees’ health conditions. However, rising premiums, compounded by IPT, risk making these valuable products unaffordable for many and could restrict access, particularly for smaller businesses and lower-income households.

“If the Government is serious about supporting the economy and strengthening the nation’s health, it should consider a targeted IPT carve out for health insurance. This would help maintain affordability, widen access to efficient independent healthcare, and ensure these products continue to play a vital role in alleviating pressure on the NHS.”

HMRC Insurance Premium Tax Bulletin

|