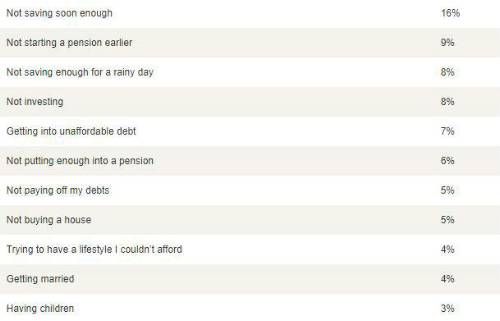

Our research shows that we’re kicking ourselves for failing to save enough for the future. The biggest financial regret, mentioned by one in six people, was not having started saving earlier. We also regret putting too little into our savings, and one in ten women rue how little they have salted away. We all need robust savings to be financially resilient enough to cope with the nasty surprises life tends to throw at us. We should be working towards 3-6 months’ worth of essential expenses in an easy access account for emergencies.

Meanwhile, almost one in ten say their biggest financial mistake was not having started a pension sooner, and more than one in 20 regret not putting more into their pension. Whatever stage you’re at in life, it’s well worth using an online pension calculator to see where you stand, and whether you need to put more aside now to be able to afford the retirement you want.

We regret our debts too. One in ten of the squeezed middle, aged 35-54, regret getting into unaffordable debt. This may be because they have so many demands on their money at this stage in life that they resent having to repay debts at the same time.

And there are plenty of people who say their biggest financial mistake was missing opportunities. 8% regretted not having invested, which rose to 12% among young people, while 5% regretted not buying a house.

Fortunately, because we know the things other people are most likely to regret, we can learn from each other’s mistakes, and by working on each of the five pillars of financial resilience, we can protect ourselves from falling into the same traps.”

Five to thrive

HL has launched 5 to Thrive: the five building blocks to build your financial resilience:

Control your debt – debt isn’t in itself a bad thing, but ensuring you can use it for your benefit rather being controlled by it is crucial. High cost debt can be particularly damaging for your finances.

Protect your family – no one is immune to something going wrong, and if something happens to you, it can hurt your loved ones. That’s why things like protection insurance, the death benefits on workplace pensions and writing a will are so essential.

Save for a rainy day – it’s impossible to predict what nasty surprises life holds in store, so it’s important to get ahead of the game by building a cash buffer for unexpected emergencies.

Plan for later life – we can’t just focus on what’s around the corner, so we need to think about the long-term too. Getting to grips with your pension and making sure you’re building a large enough pot for retirement will help protect you when you finish work.

Invest to make more of your money – once you have built your short term resilience and are confident in your pension savings, you can consider investing, which gives you the opportunity to make your money work harder for you.

Our biggest financial mistakes

|