Over the past month, several factors suggest that policymakers – particularly the US Federal Reserve (Fed) - should proceed with caution when setting monetary policy. In what’s an unusual trend, hiring in the US labour market has remained weak despite robust economic growth.

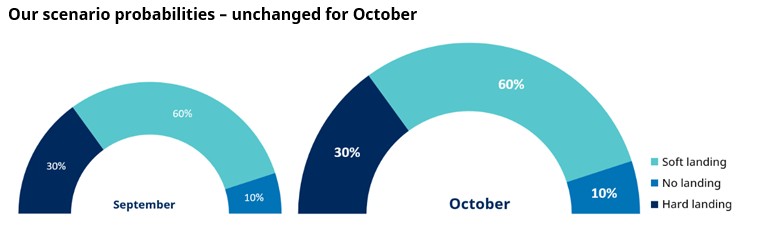

Furthermore, the US government shutdown - which has halted the release of a number of key economic releases – adds uncertainty for the Fed and investors alike. Accordingly - and given our assessment that the path of the US and global economy has not changed materially - we make no changes to the probabilities assigned to our scenarios this month, anticipating a soft landing to be the most likely outcome.

Source: Schroders Global Unconstrained Fixed Income team, 13 October 2025. For illustrative purposes only- % probabilities assigned to each scenario. We define a hard landing as one in which the Fed has moved rates by the end of 2026 into stimulative (e.g. below 3%) territory and a no landing as one where they have kept rates restrictive- we define it as above 4%. A soft-landing is one in which the Fed moves policy to within this band.

However, while overall probabilities are unchanged, our views of underlying global markets have shifted, reflecting evolving economic conditions and changes in valuations.

Investors are focused on weak US labour market data, even though broader economic data is faring better

Even though US growth remains resilient, investors have been putting greater weight on the weakness in the labour market. This more pessimistic view on the US outlook has driven a disconnect between the performance of US Treasuries – where yields have fallen (yields move inversely to price) - and with the broader economic data, which continues to exceed expectations. Although this may be a reasonable response for now, we believe the US Treasury market could underperform if the labour market stabilises - a scenario we expect as business uncertainty eases and hiring resumes.

Given market expectations, there’s scope for disappointment on the eurozone’s recovery in the near term

While we’re not overly concerned about a more sinister downturn in growth, and therefore the risk of a sustained undershooting of the European Central Bank’s target of 2%, the latest round of economic data has cast some doubt on the sustainability of the recovery in the eurozone – particularly in Germany. In the short term at least, and with investors positioned for further eurozone recovery, there is some scope for disappointment and for the market narrative to change.

Investors are focusing on the UK’s fiscal challenges ahead of November’s Budget

With the Autumn Budget set for 26 November, investors are turning their attention once again to the UK's fiscal challenges. For this reason, we retain a broadly neutral view on gilts, particularly in longer maturities which will be more sensitive to political headlines.

Where does this leave us?

Combining our economic outlook, our scenario probabilities and market valuations, we remain neutral on global duration (interest rate risk), but with differences at the regional level. This includes a less favourable view on US duration and a comparatively more constructive view on eurozone duration.

Within the eurozone, we remain negative on semi-core markets (such as France). While the pace of news is fast moving, the political gridlock makes it seemingly impossible to address the country’s fiscal challenges, warranting potential further weakness in French government bonds.

In terms of asset allocation, we remain wary of corporate credit given expensive valuations. We generally prefer sectors such as high quality emerging market debt (issued in euros) and securitised assets (including agency mortgage-backed securities and quasi-government bonds), which offer additional yield over government bonds.

|