Until last year the average cost of home insurance had been rising steadily, reaching its highest point since 2013 in Q2 2020 (£146.04). But prices have since dropped in three consecutive quarters – the first time this has happened in five years - with the rate of decline increasing each time – down 0.1% in Q3 2020, 1.2% in Q4 2020 and now 2.1% in Q1 2021.

This decline is in part due to a reduction in claims during the pandemic, which makes insurance more profitable and can lead to reduced prices. There is also increased competition in the home insurance market, which causes insurers to lower premiums to attract customers.

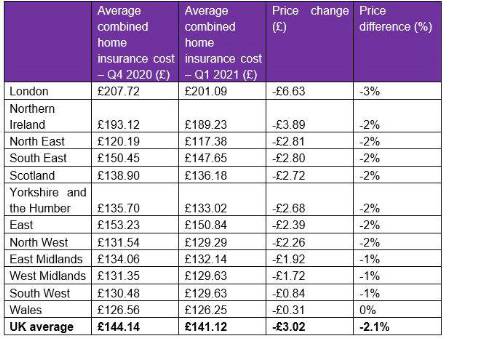

While certain postcode areas experienced an increase in costs, every region in England, Scotland and Wales saw combined policy costs dip this year.

Differences in average combined home insurance costs between Q4 2020 and Q1 2021, by region

London saw the largest percentage decrease in home insurance costs, down 3% from the last three months of 2020; however, prices in the capital remain the highest of all regions at £201.09 on average. At the other end of the table, Wales has seen the smallest price drop, down by only £0.31.

Kate Devine, Head of Home Insurance at MoneySuperMarket, commented: “Consumers will be glad to see that prices are coming down, and this decline may well continue over the coming months. Lockdown has led to fewer claims and extra competition for customers, and both generally mean lower premiums.”

“Prices remain high, however, and the easing of restrictions may see more claims, which could push prices in the other direction. It’s therefore crucial for consumers to take matters into their own hands and shop around to make sure they get the level of cover they need at the best possible price.”

You can find out more about home insurance prices and how they have changed in your area

|