Average car insurance premiums have dropped just 0.2% in the last 12 months, bringing the average costs to consumers to £809.

There are, however, signs the market is beginning to trend higher once more, with an uptick of 1.4% showing in the last three months.

Over 50s have seen an overall increase of 1.8% in the past 12 months with an average premium of £408, whilst the 25-50s have seen a slightly smaller increase of 0.6% with an average premium of £720.

Younger drivers aged under 25 continue to benefit from the largest premium reductions. The demographic has seen a price drop of 5.9% in the past 12 months, though still attracts the largest premiums (£1,734).

Interestingly, when we look at the longer-term view, the under-25s now spend 20.3% less on their premiums than in October 2013, when Consumer Intelligence first started collecting data. For the 25-50s (+29.8%) and over-50s (+45.2%), premiums have been trending significantly in the opposite direction over the same period.

Despite suffering the most expensive premiums of the cohorts, younger drivers have most control over price. Almost two-thirds (63%) of the top five cheapest quotes for under-25s are now provided by telematics providers. This figure is up 2% over the past 12 months.

John Blevins, Consumer Intelligence pricing expert says: “The market has experienced some tough times and regulation changes – such as the Insurance Premium Tax and Ogden discount rate changes, to name a couple over recent years – have forced premium increases.

“Looking ahead, despite the recent hiatus, there’s nothing to suggest the general direction of upward travel will change.”

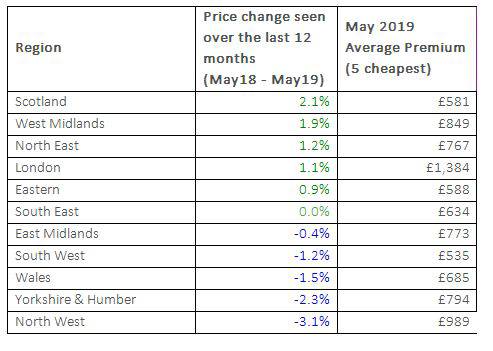

The table below shows the average premiums across the country. Scotland (2.1%) witnessed the largest price increases over the past 12 months, yet its average premiums (£581) remain among some of the lowest in the UK.

Motorists in the South West (£535) now have the cheapest car insurance, with London (£1,384) – somewhat unsurprisingly – continuing to attract the largest premiums.

The North West region (-3.1%) saw the biggest drop in prices in the last 12 months but continues to experience the second largest premiums after London at £989.

|