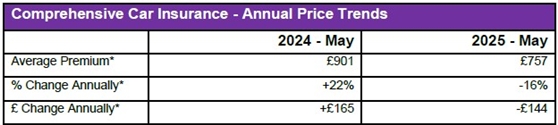

This is a significant annual percentage decrease taking prices to their lowest point in two years and continues a downward trajectory that began 18 months ago, according to the longest established and most comprehensive car insurance price index in the UK.

Average car insurance premiums have now fallen by £238 or almost a quarter (24%) since prices peaked at £995 in December 2023. The WTW/Confused.com Index also shows that in the last three months the average car insurance premium was down 3% (£20) from £777.

Source: WTW / Confused.com Car Insurance Price Index. *Average values rounded to the nearest whole number.

Tim Rourke, UK Head of P&C Pricing, Product, Claims and Underwriting at WTW, said: “Average premiums have continued to retreat from an all-time high in 2023 in the face of rising theft and vehicle repair costs continuing to put pressure on claims inflation. The current trend of market consolidation and fear of losing scale to a handful of mega-insurers may be a contributor as insurers continue to drop rates to remain competitive and maintain critical mass, despite pressure on margins likely to persist through 2025.”

Drivers aged between 17 and 19 experienced the greatest price falls compared to other age groups. Drivers aged 17 benefited from the biggest drop in prices in more than 10 years, with a substantial 27% annual price decrease, reducing their premiums by £775 from £2,826 to £2,051.

Meanwhile, drivers aged 18 and 19 saw annual price falls of 23% and 21%, taking their average premiums to £2,329 and £2,002 respectively. The age group to see the most marginal decrease to their car insurance prices were male drivers aged 21 to 25, with a fall of 12% (£219) and an average annual premium of £1,864.

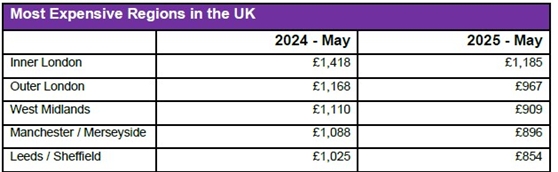

All regions across the UK recorded annual price falls over the last 12 months. Drivers in West Midlands saw the largest percentage decrease in the cost of comprehensive car insurance, with an annual dip of 18% (£201), reducing their premiums from £1,110 to £909. Despite this price drop, the region remains the most expensive area outside of the capital.

Drivers in Manchester / Merseyside also benefited from a similar percentage drop at just under 18% (£192), with their premiums decreasing from £1,088 to £896 during the same period. The smallest reduction was seen in Northern Ireland, where drivers saw a more modest annual fall of 9% (£87), with average premiums now at £852 compared to £939 in May 2024. South West England is once again the cheapest region for car insurance, where average premiums now cost £515, with Central and North Wales following close behind at £524.

Source: WTW / Confused.com Car Insurance Price Index. *Average values rounded to nearest whole number.

More locally focused data shows motorists in West Central London, the most expensive postcode in the country, benefited from the biggest annual fall in car insurance premiums, where prices dropped considerably by 24%, from £1,856 to £1,410 (£446). Average prices also fell significantly in Oldham, with drivers seeing prices fall by 21% (£250) since May 2024.

Llandrindod Wells in Wales remains the cheapest town in the UK with prices on average now costing £481. It is however no longer the only town to enjoy average premiums less than £500, now also being joined by Dorchester (£496), Exeter (£496) and Torquay (£497).

Steve Dukes, CEO at Confused.com said: “Car insurance prices have been falling for almost 18 months. And this is a reflection of insurers adapting their pricing strategies, not only to be more competitive, but to offer prices that are reflective of costs in the industry. Insurers have seen improvements in frequency of claims and also claims inflation begins to slow, while using data to gain a better understanding of customer risk and reduce price as a result.

“That said, prices are still considerably higher than they were five years ago. In order to tackle the long-term upward trend in pricing, there’s a need for the industry to look at the underlying cost of providing insurance from every angle, harnessing technology and data to increase efficiency while also improving the customer experience.”

|