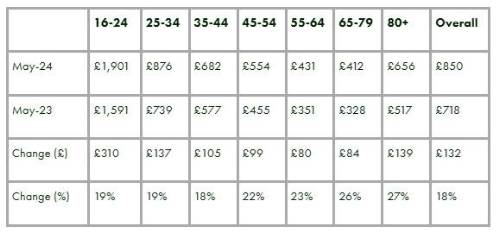

The cost of car insurance has risen by 18% year on year, according to new Premium Drivers research from Compare the Market. The typical premium stood at £850 in May 2024 after rising by £132 over the previous 12 months.

The increase in the cost of car insurance in the past year may in part be due to a rise in the cost of claims for insurers. Previously high inflation will have impacted many areas of the motor repair industry including the cost of spare parts, energy, and hiring mechanics.

Older drivers aged 80 or above have seen the largest proportional increase in the cost of car insurance in the past 12 months. The typical premium for motorists in this age group has risen 27% year-on-year (£139). Young drivers, aged under 25, have seen the steepest absolute increase in the average premium in the past year – jumping £310 in 12 months.

Compare the Market: Cost of car insurance by driver’s age (YoY)

However, in line with the rate of inflation falling in recent months, year-on-year increases in the cost of car insurance have similarly slowed. The average premium has declined by £80 month-on-month from April 2024 when it was £930. The recent increases in the cost of car insurance peaked at £951 in November 2023.

Drivers looking to reduce the cost of car insurance should consider shopping around for a cheaper deal when their policy comes up for renewal. Motorists could save up to £549 on their car insurance through Compare the Market.

Anna McEntee, Director at Compare the Market, comments: “The substantial cost of car insurance is understandably causing concern for many motorists. Our research shows motor premiums have risen by more than £100 year-on-year. Drivers aged under 24 and over 80 are seeing the steepest increases. Typically, insurers consider motorists in both age groups as more likely to make a claim which could lead them to see higher premiums. For those concerned about the cost of their motor premium, shopping around ahead of renewal is one of the best ways to try and save money on car insurance. We want to encourage older motorists who may be more inclined to stick with their existing insurer each year to compare prices ahead of renewal to see what deals are available.”

|