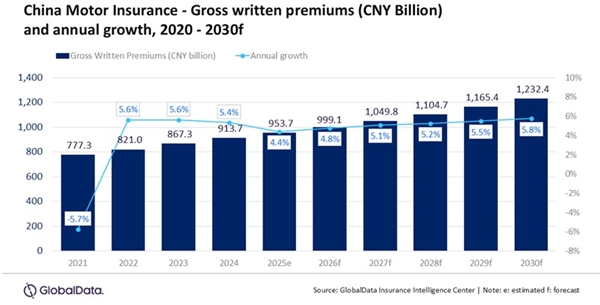

GlobalData’s Insurance Database estimates that the Chinese motor insurance industry will reach CNY953.7 billion ($133.1 billion) in 2025, reflecting an annual growth rate of 4.4%, supported by the recovery in vehicle sales, regulatory reforms, and rising new energy vehicle (NEV) penetration.

Swarup Kumar Sahoo, Senior Insurance Analyst at GlobalData, comments: "The ongoing reforms for mandatory third party cover and growing telematics adoption are expected to support premium growth during 2026-30. The trade-in policy and subsidies on vehicles, tax incentives for NEVs, and an increase in household disposable income, which led to an increase in the production and sale of vehicles in 2024, will further support the growth during the next five years.”

Vehicle production in China grew by 3.7%, while sales grew by 4.5% in 2024. According to the China Association of Automobile Manufacturers (CAAM), the sales of commercial vehicles registered an annual growth of 14.1% in July 2025. Similarly, passenger car sales registered an annual growth of 16.3% in the same month. This surge in vehicle sales correlates directly with the growth of the motor insurance market, which is projected to grow at a CAGR of 5.4% from 2026 to 2030.

The trade-in incentive provides a subsidy of CNY20,000 for NEVs and CNY15,000 for traditional fuel-powered vehicles for scrapping old cars and purchasing new ones. This is part of the government’s plan to meet the National IV emission standard. Additionally, the government provides a 10% purchase tax exemption, followed by 5% additional tax exemption.

NEVs in China accounted for 49.7% of total new vehicle sales in 2025, according to CAAM. During January-July 2025, NEV sales were 8.22 million, a growth of 38.5% compared to the same period in 2024. According to National Financial Regulatory Administration (NFRA) data, NEVs contributed around 15% of the total motor insurance premiums in 2024.

Sahoo adds: “The rise in the sale of NEVs is expected to be a major growth driver of the motor insurance market during 2026-30. Considering the growth opportunity, car manufacturers are gradually entering the insurance market. Manufacturers have data such as the health status of the battery, driving trajectories, and operating data, which put them in an advantageous position to underwrite policies. In May 2024, NFRA approved BYD to offer compulsory traffic accident liability insurance for motor vehicles in eight regions.”

NEV premiums are higher due to high associated risks. To tackle NEV owners’ opinion of too expensive insurance, the insurance regulator issued EV-guidelines to stabilize the market, and insurers have come up with split coverage (battery and vehicle coverage), usage-based insurance (UBI), and a risk-sharing mechanism to maintain coverage for high-risk NEVs.

Sahoo continues: “During 2020–24, the motor insurance loss ratio increased from 57.32% to 70.04%. Factors such as higher wreck and parts costs, and greater NEV exposure led to the increase in loss ratio.”

Insurers are investing in technology as customers are looking for solutions such as a one-stop platform, speed and efficiency of claims processing, dispute resolution, and technology-driven damage assessment. The Chinese motor insurance market is moving towards a service ecosystem, intelligent claims processing, and product differentiation.

Sahoo concludes: "The growth of the Chinese motor insurance market remains positive during 2025-30, benefitting from higher vehicle sales, accelerating NEV fleet additions, and government measures to achieve National IV emission standard. Regulators’ focus on claims transparency and pricing flexibility will support risk-based premiums. The profitability of insurers will depend upon the deployment of NEV actuarial capacities, telematics, and claims automation, and ongoing collaboration with traffic authorities to contain loss severity."

|