Average car insurance premiums have fallen by £260 (26%) since prices peaked at £995 in December 2023. Prices have now also decreased for seven consecutive quarters following a price fall of 3% (£22) in the last three months, according to the longest established and most comprehensive car insurance price index in the UK.

Car insurance premiums for drivers aged under 25 have dropped by 17% on average year- on-year. Drivers aged 17 experienced the greatest price fall compared to other age groups, benefiting from a significant 28% annual price decrease, reducing their average premiums by £780 from £2,788 to £2,008. Drivers aged 18 saw the next biggest reduction in annual prices of 20%, taking their average premiums to £2,342.

Meanwhile, drivers aged over 40 saw their prices drop on average by 15% compared to 12 months ago. Drivers aged 52 saw the most marginal decrease to their car insurance prices with a fall of 13% (£86) and an average annual premium of £585.

Source: WTW / Confused.com Car Insurance Price Index. *Average values rounded to the nearest whole number.

Tim Rourke, UK Head of P&C Pricing, Product, Claims and Underwriting at WTW, said: “The impact of market consolidation is potentially driving some broadening of footprints into traditionally less competitive areas of the market. Combined with lower claims frequencies in many segments, this may be maintaining the continued downward trend. Average premiums have now dropped for the seventh consecutive quarter despite a backdrop of high vehicle repair costs and third party injury claims inflation running higher than CPI levels.

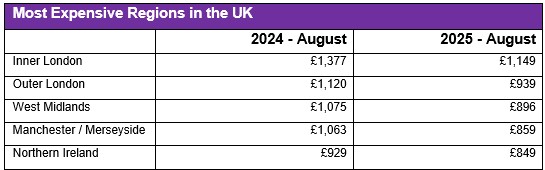

All regions across the UK recorded annual price falls over the last 12 months. Drivers in Manchester / Merseyside saw the largest percentage decrease in the cost of comprehensive car insurance, with an annual dip of 19% (£204), reducing their premiums from £1,063 to £859. Drivers in the North West of England also benefited from a similar percentage drop at just under 19% (£154), with their premiums decreasing from £830 to £676 during the same period.

The smallest reduction was seen in Northern Ireland, which was also the only region not to experience a double digit price drop, where drivers saw a more modest annual fall of 9% (£80), with average premiums now at £849 compared to £929 in August 2024. South West England remains the cheapest region for car insurance, where average premiums now cost £499, with Central and North Wales following close behind at £514.

Source: WTW / Confused.com Car Insurance Price Index. *Average values rounded to nearest whole number.

More locally focused data shows motorists in the Manchester / Merseyside postcode areas of Liverpool and Warrington benefited from the biggest annual fall in car insurance premiums, where prices dropped considerably by 21%. Drivers in Liverpool saw premiums decrease from £1,031 to £819, while average premiums in Warrington fell from £855 to £678. West Central London, still the most expensive postcode in the country, saw an annual fall of 16% (£264), with average premiums now at £1,394 compared to £1,658 in August 2024.

Llandrindod Wells in Wales continues to be the cheapest town in the UK with prices on average now costing £467, where prices fell by 13% compared to 12 months ago. Drivers in Torquay (£477), Dorchester (£481) and Exeter (£484) also enjoy average premiums less than £500.

Steve Dukes, CEO at Confused.com said: “Car insurance prices have been dropping consistently for some time - but prices are still 25% higher compared to 3 years ago. And this is having a financial impact on many customers when combined with other financial pressures they’re facing. It’s important that, as an industry, we don’t lose focus on the underlying factors which are pushing premiums higher than they have been historically. There’s still a significant opportunity to work together to deliver further value to customers.”

|