Consumers are increasingly using credit to pay for insurance cover and switching to monthly payments for car and home insurance to manage their bills, new research1 from the UK’s leading premium finance company, Premium Credit, shows.

Premium Credit’s Insurance Index, now in its sixth year, found that 76% of insurance customers use some form of credit to pay for one or more policies compared with 71% in March last year and 70% in March 20233.

Two out of five (43%) customers who use some form of credit to pay for one or more insurance policies borrowed more than they had in the previous 12 months for this purpose. This year’s index shows an increase of 32% in the amount customers estimate they borrow to pay for insurance - now at £400 compared with £302 last year. Around 42% say they have not borrowed more while 4% say they have borrowed less and 11% didn’t know or preferred not to say.

The index, which monitors insurance buying and how it is financed, shows a continuing switch to paying monthly rather than annually. One in five (19%) motorists say they have switched to monthly payments for insurance since the cost-of-living crisis started in 2021 compared with just 9% who have swapped to paying annually. Last year’s index found 15% of motorists had switched to monthly payments and 8% had switched to one-off lump sums.

Around 15% of home insurance customers switched to monthly payments over the same period according to this year’s index, while 9% moved to annual payments. Figures from last year showed 11% switching to monthly payments and 7% ditching monthly payments.

The main reason for increasing borrowing was the ongoing cost of living squeeze. Around 43% said they borrowed more to ease financial pressures while 24% said it was because their premiums had increased.

Around 6% who used credit to pay for one or more insurance policy said they had defaulted on repayments during the past year which is unchanged from last year. The index found 7% of those using credit to pay for insurance think they might default on repayments in the next 12 months.

Premium Credit’s Insurance Index found credit cards are the most popular form of borrowing despite the potentially high cost. Around 41% rely on credit cards while 29% use the finance offered by their insurer and/or premium finance provider. Last year’s index found 35% relied on credit cards and 25% the finance offered by their insurer and/or premium finance provider.

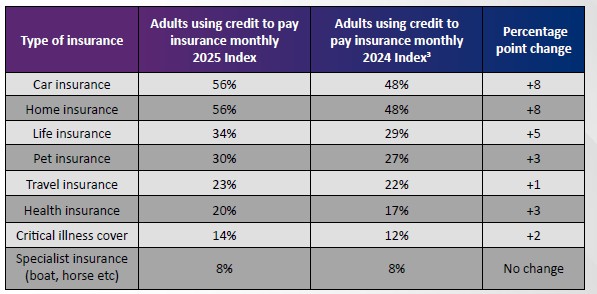

The index shows widespread use of credit by consumers to pay for all types of insurance as the table below shows.

Mona Patel, consumer spokesperson, at Premium Credit said: “The number of people using credit to pay for insurance continues to rise and there is a growing trend to paying monthly to make cover more affordable. Consumers pay monthly for a wide range of products and services to help them manage their budgets. Premium finance is specifically designed to take away the pain of paying out a large lump sum. Spreading the cost of an annual policy into more convenient monthly payments is hugely helpful for many millions of UK consumers. It can also be a good alternative to other forms of credit like credit cards or bank overdrafts.”

Premium Credit’s research highlighted the cost of not having the right insurance – around 8% of those who use credit to pay for insurance have not been able to make claims in the past five years either because they had no cover or had inadequate cover. Around 62% of them were unable to claim for damage of £1,000 or more.

The full report is available to download here

|